5 minutes

Here’s how credit unions can help protect their members from the costs of replacing a vehicle in these uncertain times.

Sponsored by SWBC

The auto industry is in a unique state of flux right now. Inventory is on the rise as automakers overcome supply chain challenges that pervaded the pandemic. Car prices are on a slight decline but remain close to $48,000 on average. Yet, interest rates are still elevated at an average of 6.58% and 11.17% for new and used cars respectively, with no clear indication of whether they will return to pre-pandemic norms.

On the consumer side, members are keeping their vehicles longer, most likely deterred by the high monthly expense of owning something newer. But there is something else members should be factoring into the cost of vehicle ownership that may not be as apparent as interest rates and transaction prices. It’s a factor that can quickly erode the value of investing in a new car—and negatively impact a member’s ability to sell or trade in their vehicle. It’s depreciation.

In this article, we’ll take a closer look at recent auto industry trends, explore their potential effect on vehicle depreciation, and see what credit unions can do to help protect their members from the costs associated with replacing a vehicle in these uncertain times.

The State of the Auto Industry

Although the industry has not fully recovered from pandemic-era supply chain issues, many auto manufacturers are beyond the biggest obstacles, for now. As a result, inventories have slowly improved over the last two years, resulting in roughly 1.89 million available unsold new vehicles at the end of March 2023. That number marks the highest level of supply since April 2021.

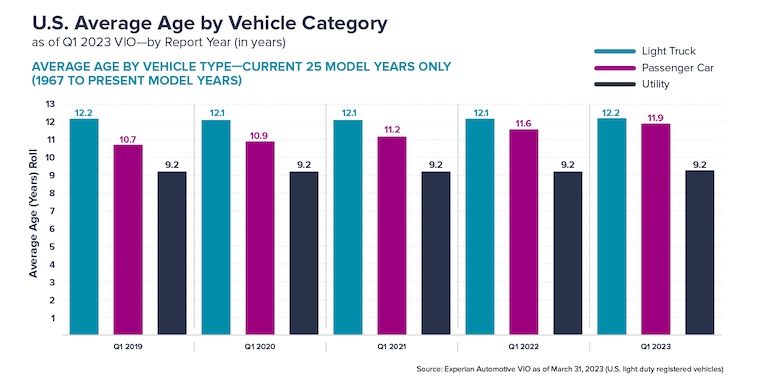

That did not happen without the help of consumers, however. In a recent auto briefing from Experian, data showed that new registration volumes of passenger vehicles declined over the last five years, indicating the average age of vehicles on the road has increased to 11.9 years. Likely motivated by poor economic conditions, members are keeping their cars longer, allowing auto manufacturer inventories to slowly—yet steadily—increase.

Now, auto dealers are left with more inventory than in previous years and there could be pent-up demand in the marketplace for an upgrade. Key factors are in place for a 2024 car-buying season unlike one we have seen in several years. With automakers shaking off their inventory woes, they are motivated to sell, incentivizing deals with cash back and special financing for qualified buyers. Charlie Chesbrough, senior economist for Cox Automotive, recently stated: “With some brands and segments nearing too-high levels of inventories, we are seeing discounts and incentives increase.”

But will these incentives be enough to get members to finance a newer vehicle, especially with car prices and interest rates remaining high? While the auto market has some indication of stabilizing, there are still many questions surrounding what new normal we can expect.

Navigating Depreciation Is a Bigger Challenge in Today’s Economy

Depreciation is an unavoidable reality in the world of car ownership, one that begins as soon as the new vehicle is driven off the lot. Perhaps the biggest reason depreciation should matter to car buyers is it affects the total cost of ownership: the higher the rate of depreciation, the more money is lost over time. This is especially true for a member financing their purchase in our current economy, as a high loan origination amount and elevated interest rate may make it difficult to pay down the principal in a manner consistent with the rate of the vehicle’s depreciation.

How quickly a car loses value depends on several factors, including vehicle age, model and condition. Supply and demand also contribute to its value, both of which have been deeply impacted by the pandemic. According to a study from iSeeCars, the average five-year-old car depreciated by 33.3% in 2022. In 2021, that rate was 40%.

Karl Brauer, executive analyst for iSeeCars, told CNBC, “The relative scarcity of late-model used cars due to pandemic-related new car production disruptions has kept used car values high for more than a year.”

The upcoming year may be different, however, as new car inventories have climbed upward. While vehicles have held their value over the past few years, all indications are showing that 2024 should bring the “return to normal” that we have been expecting post-pandemic.

How Members Can Better Manage Depreciation

The costs associated with vehicle depreciation aren’t usually realized until a vehicle is traded in, refinanced, or experiences a total loss or unrecovered theft. Although there is nothing members can do to stop depreciation, there are some strategies they should be aware of to help insulate themselves financially from its effects.

A key component for decreasing exposure to depreciation is purchasing vehicles that hold their value over time. Such vehicles typically have higher dependability ratings, lower overall cost of ownership or are in high demand. Researching the types of vehicles that retain their values longest is a good start. Using data from Kelley Blue Book, Forbes compiled a list of vehicles with the highest resale values, which include Toyota, Honda and Tesla.

Keeping vehicles in great condition—including completion of routine maintenance and addressing mechanical issues before they become larger problems down the road—will help retain their value. Vehicles with more wear and tear or repairs that have not been addressed will have an increased depreciation rate.

Despite their best efforts in researching all options and caring for their vehicles, most members still need protection against depreciation. Some insurance providers, including SWBC, offer up to 60 months of depreciation protection while giving your members an incentive to return to your credit union to finance a replacement vehicle after a total loss or unrecovered theft.

Equity protection products are independent from guaranteed asset protection. While GAP waives the outstanding loan balance at the time of the loss, equity protection provides a loyalty benefit equal to the difference between the cash purchase price or value at the time of refinance and the insurance settlement amount from the primary carrier. This benefit can offset the decrease in the vehicle’s value over time, as well as protect the investment the member has made through initial down payment or subsequent payments.

Crystal Bullard is VP/product management/auto and loan protection products at SWBC, a CUES Supplier member based in San Antonio, Texas. As part of SWBC’s Financial Institution Group, Bullard works with lenders to increase their interest and non-interest income through programs such as AutoPilot Lending and specialty products. Before joining SWBC in 2015, she served as consumer lending retention program manager at Golden 1 Credit Union, Sacramento, California, developing strategies to increase credit union wallet share and retention of direct and indirect loan members.