9 minutes

Develop a purpose statement for your credit union that works to improve members’ health, wealth and happiness.

A growing number of leaders are championing what they call conscious capitalism—building companies based on the idea their business is about more than just making a profit.

Think Costco, Trader Joe’s, REI and Whole Foods.

In fact, purpose is the path toward future growth. According to Entrepreneur magazine, conscious capitalism-inspired companies are outperforming the market by a factor of 10.5.

The shift to conscious capitalism started long before COVID-19, but the pandemic has acted as a catalyst, revealing the need for companies to have a purpose beyond profits in order to compete in a world with increasingly conscious consumers.

Credit unions are primed for this as they are guided by the “people helping people” philosophy. However, through our ongoing research we are finding a growing “people helping people” gap in the digital channels of credit unions.

While many retail companies have been quick to leverage purpose (think Tom’s, Bombas, or Patagonia), financial brands have been slower to adapt, still relying on promoting their commoditized products and services for future growth.

This is why to succeed in a post-COVID, digital-first world, credit unions must stand out in some way, to move beyond the promotion of dollars and cents. And you can do this with purpose.

Unfortunately, the vast majority of financial brands are not purpose driven. Yes… even credit unions fall into the commoditization trap. Instead, they’re often guided by traditional mission and vision statements.

These statements are inward focused and self-serving, only addressing the needs of the financial brand. While there is nothing wrong with having a mission and vision statement, there is a third statement that can be truly transformative: the purpose statement.

The purpose statement is outward-focused and is intended to build trust and create value for people, resulting in a positive emotional response.

Why does it matter so much that your purpose statement, this third way, is not inward-looking like the mission and vision statements?

Because it’s that very narcissism and tunnel vision that created the situation we’re in as an industry to begin with.

It’s the reason that people don’t trust financial brands.

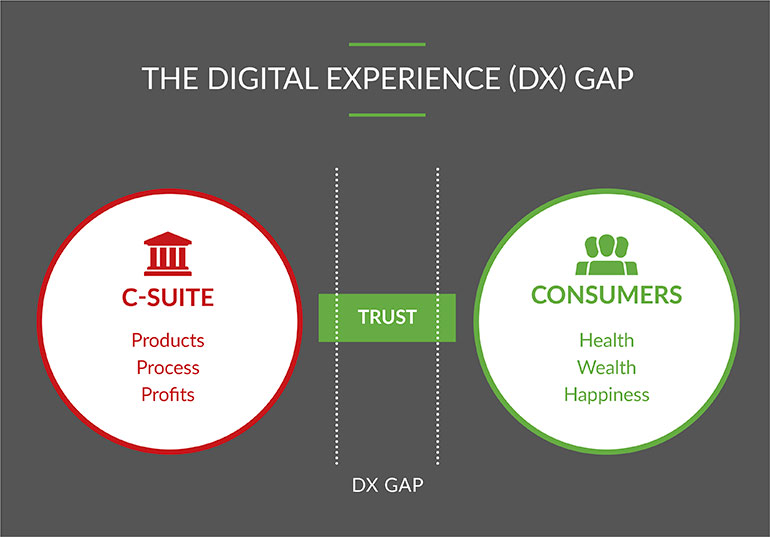

The Digital Experience Gap

Spend five minutes studying the financial industry and you’ll spot it right away: There is a lack of trust between consumers and financial brands. Dig a little deeper and you’ll find out why.

You see, financial brand leaders are driven by the three Ps: products, process and profits. And no, credit unions are not immune from this either. I’ve heard multiple credit union leaders of late talking about the need to, “drive more sales,” or to, “push products down people’s throats.”

Consumers, however, are driven by totally different factors: health, wealth and happiness.

These two sets of drivers are so misaligned that conflict is bound to arise. That misalignment and the resulting conflict is what leads to a lack of trust on the consumer’s part. They don’t feel like financial brands truly want to help them achieve health, wealth and happiness.

This raises an important question: is it possible to bridge the consumer-trust gap and help provide the health, wealth and happiness your members want without sacrificing your products, process or profits? Or is that misalignment impossible to rectify?

It is possible to bridge that gap with purpose and empathy. With purpose, you send the message that you care about more than just profits. With empathy, you can better understand and address members’ needs. Both are key for bridging the consumer-bank trust gap, which can generate more profits in the long run for financial brands, not less.

Before you can begin bridging the gap, you need to know why trust and empathy are so effective. To do that, you must understand how the brain works, then how to use these twin forces to establish and maintain strong, trusting relationships with members.

Understanding the Consumer’ Brain

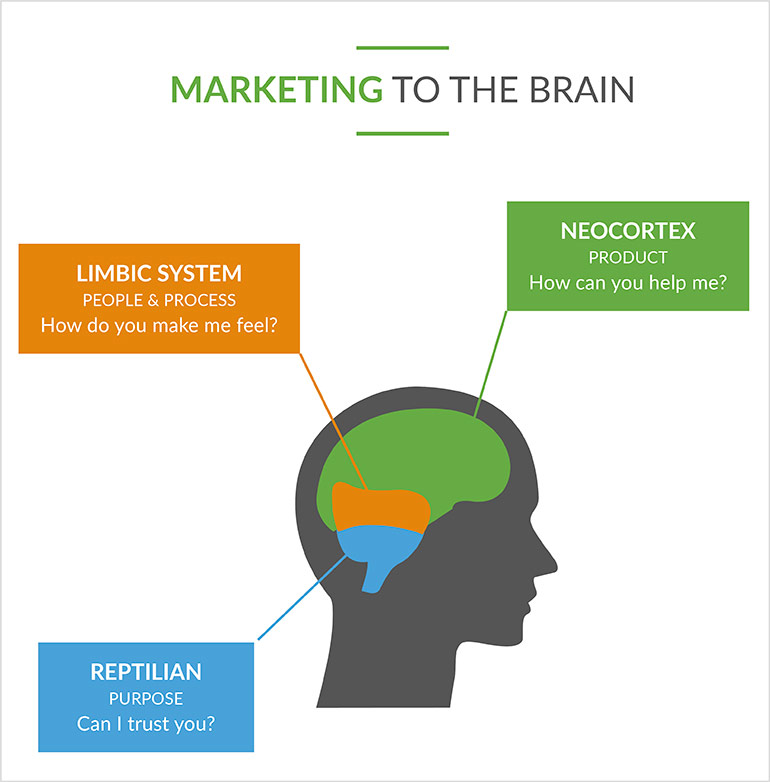

There are three main parts to the brain.

- There’s the neocortex, which is the “thinking brain,” where logic and reason reside.

- Then there is the limbic system, which is the “feelings brain,” where emotion lives and memories are stored.

- Finally, there is the “reptilian brain,” which is what we depend on for survival.

From a banking perspective, when your marketing messages are communicating to members about your credit union’s great rates, amazing service and commoditized laundry lists of look-alike product features, you’re very much speaking to their neocortex or “thinking brain.”

The problem? Every financial brand is communicating to the thinking brain. As a result, the average consumer’s brain is overloaded with this type of information. You don’t stand a chance of standing out amongst all the noise in their thinking brain.

The opportunity for you is to step back, transform your marketing and sales communication strategies, and speak into the other two parts of the brain first.

Trust is formed in these parts of the brain. The first layer of trust is formed in the reptilian brain, which completes a binary friend-vs.-foe assessment, and the second layer of trust is developed in the feelings brain, which builds relationships.

If you want to bridge the trust gap, you must speak to these other two parts of the brain.

Purpose Beyond Profits: Tap into the Reptilian Brain

To bridge the consumer trust gap, you need to start with messages targeted at the reptilian brain. This part of the brain is all about survival—fight or flight, friend or foe. It’s the part of the consumer’s brain that decides whether they can trust your financial brand in a broad, binary sense.

Purpose is the key to tapping into the reptilian brain and earning that trust. Consumers are looking for someone they can trust to guide them to a bigger, better and brighter future. If your only purpose is profits, consumers will assume that you do not have their best interests at heart and are only interested in their money. Their reptilian brain will shout, “Foe!”

When you have a purpose beyond profits—especially if it’s a purpose members can believe in themselves—you transform consumers’ perspective of your financial brand. The consumer’s inner reptile is less likely to shout “foe” and more likely to instinctively label you as “friend.”

Positioning around a purpose that transcends the promotion of commoditized products can absolutely generate revenue. Put simply, purpose is the path toward bigger profits.

Purpose alone can go a long way to bridging the consumer trust gap, but it’s even more powerful when combined with empathy, which is found in the feelings brain.

Empathy Is Everything: Unlock the “Feelings Brain”

Empathy is defined as “the ability to understand and share the feelings of another.” Empathy is a key part of the limbic system, or the “feelings brain,” which is where relationships are formed, and both memories and experiences are stored.

If the primary question the reptilian brain asks is, “Can I trust you?,” the question being asked by the consumer’s limbic system is, “How do you make me feel?”

As a financial brand, when you operate from empathy, you understand that everything is about the consumer, not you. What are their needs, problems and dreams, and how can you help them? In today’s digital world, empathy is perhaps the most important competitive advantage a financial brand can have. It tells the consumer: We see you, and we understand how you feel.

How you make the consumer feel will be determined by how well you utilize empathy, leveraging your understanding of the emotional needs of people within the communities you serve and the process through which you emotionally connect with them.

Let’s return to that all-important P: profit. What exactly is the value in creating an emotional connection with members? In Motista’s report Making the Emotional Connection of Financial Services, we see that an emotionally connected account holder creates between 30-100% more value for a brand than just a “highly satisfied” account holder. Motista also found that emotionally connected account holders, established through purpose and empathy, resulted in a six times multiplier of lifetime value.

When you make a positive emotional connection with a member through empathy, you demonstrate that you care about them, which helps create a relationship and inspires loyalty, which means more profits in the long run.

Now that you understand the importance of empathy in trust when it comes to differentiating your financial brand, let’s look how to craft and apply a purpose statement.

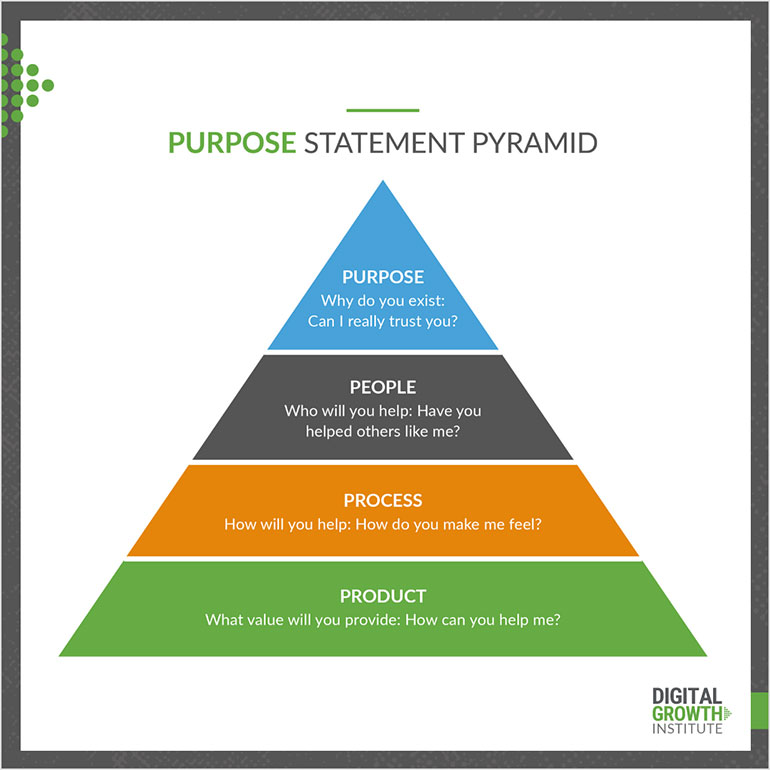

How to Craft a Purpose Statement

Start by crafting a purpose statement that allows you to communicate your purpose with clarity and simplicity.

Your purpose statement will be composed of the following four elements that tie back to the different parts of the brain we just unpacked:

Your who: the people you’re creating value for

Your what: the value you create with your product or service

Your how: how you create value through your process

Your why: the reason you exist—how you want to make people feel—your purpose

Apply Your Purpose

Once you’ve defined your purpose statement, it’s time to apply it.

Applying your purpose starts with your whole credit union and culture living and communicating it internally. An added benefit of purpose is that it’s an intrinsic motivator not just externally, with members, but also internally, with your staff.

Then you apply your purpose externally in the communities you serve through the communication and actions of your marketing and sales teams.

It’s what you say, it’s what you do, and it’s how you build trust with people.

Your purpose statement also becomes a digital positioning statement to attract like minds, both internally and externally, who believe in your bigger purpose beyond the promotion of commoditized products.

Without action, purpose is just branding. And for the most part—I hate to say it, but it’s true—the branding for most financial brands is crap. It’s just pretty pictures, colorful logos, shiny happy stock people, not real life.

When it comes to purpose, branding must transcend these shallow images.

In today’s digital economy, purpose is the brand.

It’s why you do what you do.

But if purpose is not backed by proof (the how), the why is only skin deep, just like those pretty pictures.

James Robert Lay is one of the world’s leading digital marketing authors, speakers, and advisors for financial brands. As a digital anthropologist based in Houston, TX, James Robert is the author of the bestselling book, Banking on Digital Growth. He is also the founder and CEO of the Digital Growth Institute where he has guided more than 520 financial brands on a mission to simplify digital marketing and sales strategies that empower banks and credit unions to generate 10X more loans and deposits.