4 minutes

The challenge of effective CEO evaluation

It never fails—when I’m with a group of board members (which is very, very often) and I ask “What are your core responsibilities?” someone will always say, “to hire and fire the CEO.” And yes, I suppose at a very basic level this is true. Perhaps there is no more important decision a typical credit union board makes than in the hiring of a CEO.

It never fails—when I’m with a group of board members (which is very, very often) and I ask “What are your core responsibilities?” someone will always say, “to hire and fire the CEO.” And yes, I suppose at a very basic level this is true. Perhaps there is no more important decision a typical credit union board makes than in the hiring of a CEO.

There is, of course, so much more to developing a successful relationship with a credit union CEO than in his or her hiring and firing. If you were to think back over your career and consider the best mentors you had—the ones who were able to elicit from you your finest moments as an employee—certainly you would consider their contributions to your career far beyond the moment they hired (or even fired) you.

Indeed “CEO support and oversight” (not solely hiring and firing the CEO) is a key board responsibility that Quantum Governance focuses on. (The others are governance and leadership; performance and results; strategic thinking, learning and planning; budget and resources; membership and community outreach; and stewardship, ethics and financial integrity.

On the whole, my colleagues and I sometimes worry that credit union directors spend too much time focusing on fiduciary and operational- related matters. Ideally, we would like to see you talk a bit more at the strategic level in the board room. However, one area where we do see a great deal of variability--and perhaps a greater need to focus at the fiduciary level—is in the assessment process of the CEO.

What does an effective or “constructive partnership” between the board and your credit union’s CEO look like? That is, what kind of relationship do you have—and will you forge in the future—with your CEO? What are the appropriate operational and strategic boundaries? How, in the big picture, can you help your CEO be even more effective? What goals should you set for your CEO? Should your CEO’s goals be the same as the goals of the credit union as a whole—or should there be goals unique to him or her? Ultimately, what type of process is appropriate to provide an effective CEO assessment?

There are real challenges in the answers to these vital questions. In Quantum Governance’s work, we assess credit union boards nationally, and less than 30 percent of board members we’ve surveyed think they effectively establish performance goals for their CEO. And only slightly more (35 percent) think they are effective in holding their CEOs accountable for such goals when they have been established. If my math is correct, that means only about 10 percent of credit union boards perceive they are effectively holding their CEOs accountable to an agreed-upon set of performance goals!

To maintain a truly effective constructive partnership with your CEO, a board must thoughtfully and collectively work to build, foster, maintain and improve the relationship. A regular and genuinely valuable assessment process of the CEO is vital. It can provide:

- a more objective and comprehensive analysis of your CEO performance,

- a higher degree of focus on key credit union goals, efforts, and initiatives,

- an in-depth look at important leadership strengths – as well as challenges,

- a means for your credit union’s leadership to get “un-stuck,”

- a way to reframe key governance, leadership and strategy issues,

- baseline data to measure future efforts and progress, and

- new ideas, insights and ways to move the credit union forward.

And yet, sadly our surveys show that a third or more of credit union board members feel they are doing an “ineffective” or only “adequate job” of using a quality process that allows all board members to provide input on the CEO’s evaluation. Such a process is a vital element in maintaining a good relationship with your CEO over time.

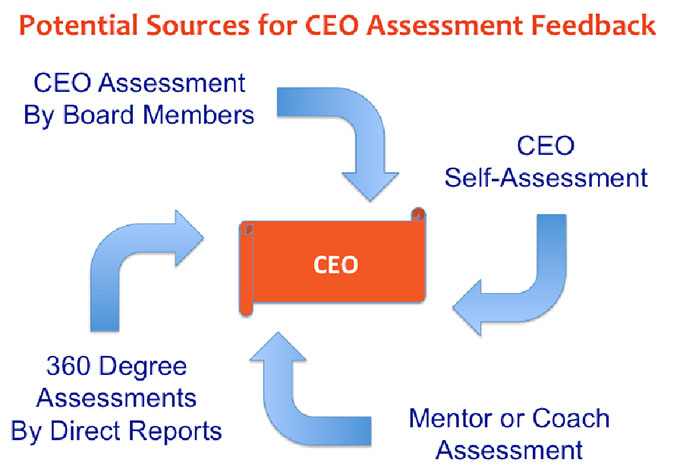

In addition to ensuring that all board members have an opportunity to provide input into the CEO assessment process, here are other options to seriously consider:

For example: 1) you could also ask your CEO to complete a CEO self-assessment tool aligned with the question set board members use to provide feedback; (2) you could ask for 360-degree assessments by direct reports to the CEO; and, in appropriate instances, (3) you could ask for mentor or coach assessments of the CEO.

For example: 1) you could also ask your CEO to complete a CEO self-assessment tool aligned with the question set board members use to provide feedback; (2) you could ask for 360-degree assessments by direct reports to the CEO; and, in appropriate instances, (3) you could ask for mentor or coach assessments of the CEO.

The immediate goal is to provide valuable feedback to the CEO that accurately assesses his or her efforts and gives genuinely helpful guidance to improve overall performance. The ultimate aim is to build an effective partnership that will help your CEO and, through his or her efforts, actively assist the credit union and its members to succeed.

In many respects, there really is no higher calling before you as a board.

Michael Daigneault, CCD, serves as CEO of Quantum Governance, L3C, a CUES strategic provider in the area of governance. Daigneault has more than 30 years of experience in the field of governance, management, strategy, planning and facilitation. With more than 30 percent of Quantum Governance’s work being representing credit unions, the organization fields more engagements in the credit union community than in any other. Daigneault has also served as an executive in residence at the University of Toronto’s Rotman School of Management as part of CUES Governance Leadership Institute.