3 minutes

Examine your board’s practices today and decide which to keep and which to pitch.

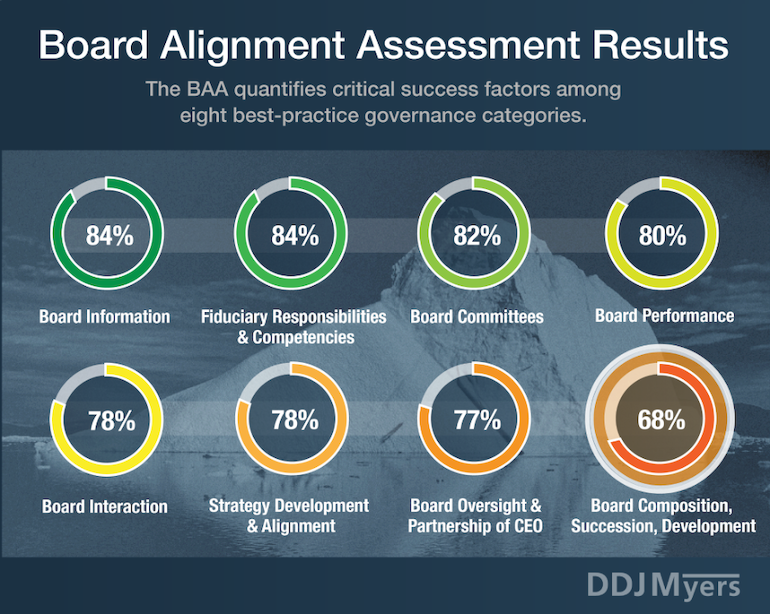

At DDJ Myers, we quantify and measure eight best-practice governance categories through a board assessment tool. Our goal is to give boards—as self-governing fiduciary bodies—an easy way to assess performance, leverage strengths, identify gaps and measure progress. Doing an assessment helps boards create a unique-to-them roadmap for development. Boards appreciate this approach.

When boards review these results, the phrase “term limits” inevitably finds its way into the conversation. And more often than not, it’s a sensitive topic. At a recent industry conference, a CEO introduced me to some of his board members, and no joke, right out of the gate, one of them said, “We’re looking forward to working with you, but you need to know there is one topic that is out of bounds: term limits.”

DDJ Myers was not contracted for a governance program with them but rather a strategy conversation. In the countless times our CEO, Deedee Myers, or I have spoken at conferences, we have never asserted that all boards should have term limits. My assessment is that he was revealing his sensitivity to a board succession conversation. Side note: When we did get into multiple strategic sessions with the board, the CEO charged me with a goal, “If you can get the board talking during our session, that’ll be the cherry on top of this engagement.” (I did!)

What the Data Say About Succession

Data, one of the biggest influencers of our time, has a few lessons for us about board composition and succession planning that may be bitter to taste and even harder to swallow. So brace yourself and read on as I summarize some key findings from working with your peer credit union boards. We hope the lessons stimulate your appetite for action because something has to change drastically in the conversations regarding credit union board composition and succession.

Across our client pool, the lowest self-assessed performing category by a large margin year after year has been board composition and succession (68%). The next lowest category is board oversight and partnership of the CEO, scoring at 77%. Boards, by their own admission, lack succession plans that they can be proud of, and that is probably why the National Credit Union Administration has proposed a rule requiring CUs to have a succession plan in place.

If boards can see that succession is not about term limits but a constructive conversation and an action plan that addresses what talent is needed in the boardroom to appropriately pace the evolving needs of the organization, I guarantee more constructive and organization-centric (not self-preservation) conversations will ensue. Now is the time for boards to do their part in helping their organizations evolve by putting everything on the table and evaluating their practices to see what they need to enhance and what they need to keep or ditch to evolve as a stronger organization.

Peter Myers is SVP of CUESolutions provider and Advancing Women sponsor DDJ Myers, an ALM First company. DDJ Myers has been working with credit unions in a professional development capacity since 1989. The company has won awards for our innovative and impactful work across the country with organizations of all shapes and sizes. As part of its CEO succession planning process, executive search work, or strategy development and deployment programs, DDJ Myers deploys its board alignment assessment, an online assessment tool that enables boards to assess performance, leverage strengths, identify gaps, and measure progress as a self-governing fiduciary body.