4 minutes

Stand apart from the competition by helping members of all ages with overall financial wellness.

Sponsored by Franklin Madison

Credit unions face more financial service competitors than ever before and are challenged with attracting new members and retaining existing ones. But there is one way credit unions can help their members, stand apart from others, and create loyalty: by helping members with their overall financial wellness.

We highlighted some strategies to help credit unions find new ways to focus on the financial wellness of their members in our most recent report, How to Be a Valuable Partner to Consumers in Difficult Economic Times.

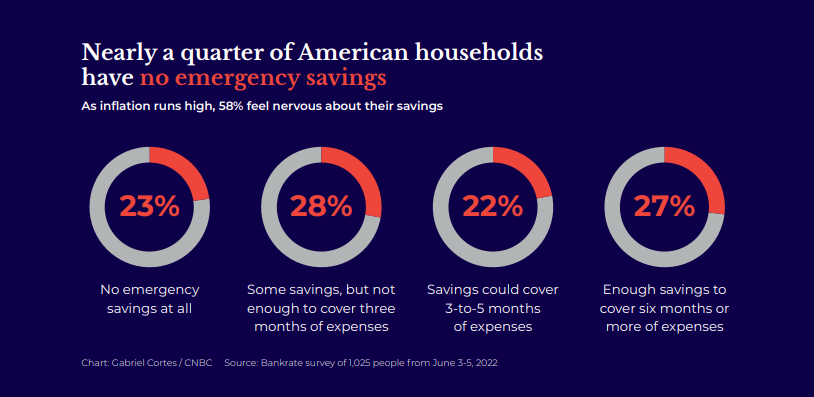

The average person is more concerned about their financial lives than ever before and is looking for a partner who can help. A June 2022 survey from Bankrate found that nearly 60% of consumers feel they don’t have enough money set aside for emergencies.

We may not be experiencing a severe recession, but high interest rates and persistent inflation are hurting the consumer dollar.

Two-thirds of U.S. adults say money is a “significant source of stress,” according to a survey by the American Psychological Association. And money-related stress is even higher among younger adults ages 18 to 43, registering at 82% for ages 18 to 25 and 81% for ages 26 to 43.

Surprisingly only 43% trust them to help look after their long-term financial well-being, according to an Accenture poll.

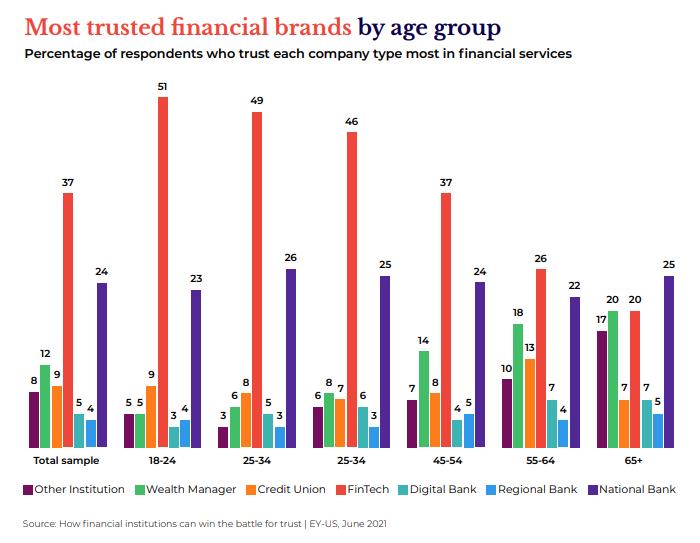

Further, a survey of more than 5,000 consumers from Ernst & Young found that more people cited a fintech as their most trusted financial brand, as opposed to a traditional financial institution. This figure was especially higher among younger consumers.

“Providing financial wellness services for your customers could have a positive impact on your business and your bottom line. When your customers show loyalty to your business, feel less stress and maintain good habits, they may be more likely to continue doing business with you and potentially refer your products and services to friends and family,” notes an article from Experian.

Financial institutions have a significant untapped opportunity to enhance their customers’ financial well-being by offering supplementary insurance products. By leveraging data, they can offer the most suitable insurance products to individuals at the right moment. These offerings may include complementary insurance, such as accidental death and dismemberment or other relevant insurance products at affordable prices that enable customers to save money.

These products can help put a few hundred dollars back into a customer’s pocket, which is invaluable during times when financial stress is high. Moreover, they require no financial investment from the financial institution and are complimentary for customers, unless they choose to purchase additional coverage. This approach presents a simple way to deliver value and foster customer loyalty.

For individuals seeking greater financial security and peace of mind, life insurance and hospital accident insurance products can contribute to their stability during emergencies, and credit unions can be the ones to offer this to them. By providing these insurance options, credit unions can further cultivate trust and loyalty among customers, solidifying their position as reliable providers of comprehensive financial wellness solutions.

Financial Wellness Needs Differ Based on Generations

Baby Boomers are best served when their retirement and fixed incomes are protected. They tend to be more interested in retirement planning services, reverse mortgages, fraud protection and any kind of insurance that fills potential gaps in their other coverage to avoid draining their retirement with uncovered charges.

Gen X shows more interest in personal loans and investment products. They are at a stage of life where they may have significant financial obligations, such as mortgage payments and college tuition, and they may need insurance to protect against expenses due to a disabling injury or illness.

Millennials are interested in being empowered and having convenient access. They want financial education, digital wallets, personal investment services, renter’s insurance, pet insurance, identity theft protection and life insurance as they start a family.

Gen Z can be won over with budgeting tools, credit-building products, student loans, mobile banking and renter’s insurance.

The approach you take in introducing products to these different generations needs to vary in both message and medium.

To start, it’s important to understand the channels and platforms that each generation prefers. For example, the such traditional media as television and print ads, while Millennials and Gen Z are more likely to use social media and online sources.

All in all, direct mail has demonstrated its role as one of the most effective forms of marketing across all generations. It is especially effective by utilizing data in an omnichannel approach and allowing consumers to opt in digitally, by phone, or by mail. Direct mail spans all generations, and omnichannel is a practical way to give all generations communication preference options.

An industry leader with over 50 years of experience, Franklin Madison builds financial security for individuals and families by delivering innovative insurance products and marketing services through its brand partners. A CUESolutions provider, Franklin Madison helps generate increased loyalty and revenue for more than 3,500 financial institutions.

Helping your members develop their financial well-being doesn’t have to involve investment or a heavy lift from your staff. Franklin Madison’s Smarter Insurance Marketing approach can create value for both you and members, delivering products that drive consumer loyalty and an increase in non-interest income. Follow us @frnklnmadison and on LinkedIn.