3 minutes

A data-driven look at CUs’ current situation

A critical issue for credit unions going forward will be the need to improve their efficiency ratios. A big focus in doing so has to be on more effective revenue generation rather than on cost reduction.

That doesn’t mean that credit unions shouldn’t watch how they spend their money, but it does suggest that bigger gains will be had by focusing on loan generation and effective pricing of loans.

The industry also will need to continue to pay attention to the cost of funds. There will be a lot of pressure on core funding rates in 2023, and simply following interest rates up on the deposit side for competitive reasons will put additional pressure on the efficiency ratio. We need to be more nuanced in how we price both deposits and loans in 2023.

To help illustrate these ideas, my team and I have pulled together some data on credit union performance related to efficiency. These are data for all credit unions above $25 million in assets, as the very small ones distort the numbers to some extent.

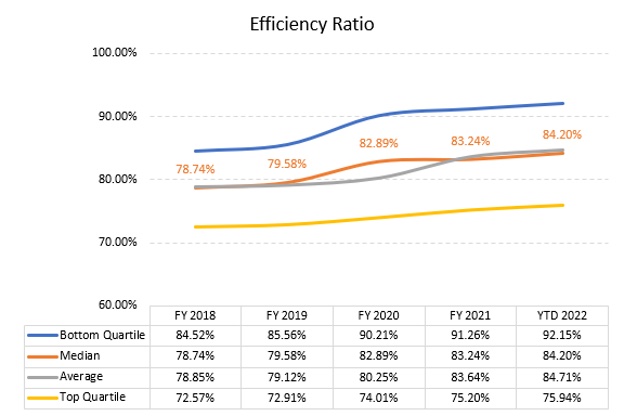

CUs’ Efficiency Ratio Has Declined for the Last Four Years

Credit unions’ efficiency ratio—expenses (not including interest) divided by revenue—has declined over the past four years. The lower the ratio the better, with many financial institutions striving to be below 50%.

Credit unions’ median efficiency ratio went from 78.7% to 84.2% between year-end 2018 and June 2022. While it has worsened across all quartiles, the decline was worst at the bottom quartile, going from 84.5% to 92.2%. The top quartile also declined, but less so, from 72.6% to 75.9%. The declines in efficiency were consistent across the years, but the jump was most pronounced from 2019 to 2020. This probably was probably impacted by the pandemic, rapidly declining rates, an influx of deposits from stimulus payments and lessened loan demand reducing revenue dramatically for many credit unions. Additionally, many credit unions were waiving fees in this period, which would have added to the problem.

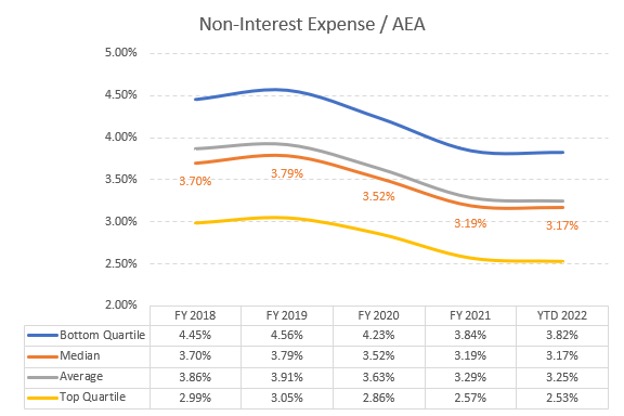

Revenue Growth Associated With Asset Influx Minimal

This second chart shows expense to assets. AEA is average earning assets.

The trend here is interesting as it illustrates an upward trend from 2018 to 2019 but then dramatic declines from 2020 through mid-year 2022. The industry wasn’t reducing expenses, but assets were growing rapidly with pandemic-related growth in deposits again being a key factor. However, credit unions were unable to effectively deploy those assets, so the revenue growth associated with those assets was minimal, and we saw declines in the efficiency ratio even as expense per assets was improving.

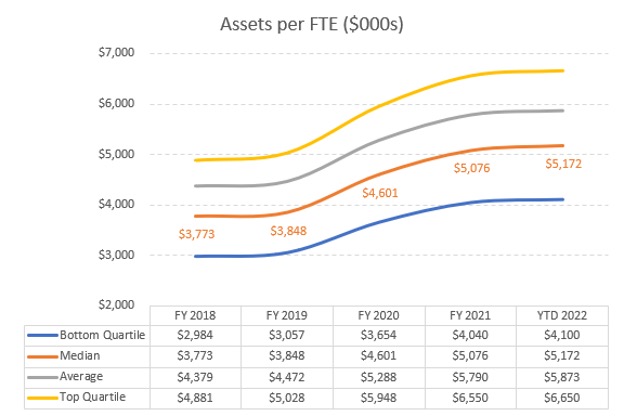

Assets Per Full-Time Employee Increases Usually Correlates With Improved Efficiency

Further supporting the notion that the primary driver of reduced efficiency ratios was non-productive growth is this chart. Assets per FTE (full-time equivalent employee) increased significantly over this time, which normally correlates with improvements in efficiency. This means assets were not productive enough in generating revenue.

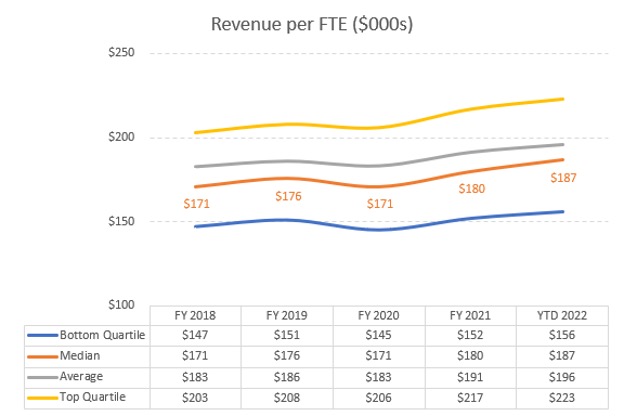

Compare the Two Slopes

This final chart shows revenue per FTE. If also has a positive slope over the period, although it did decline in 2020. The important idea is the slope of this line versus the slope of the line in the previous chart. This one is shallower, an indication that revenue per FTE was not growing at nearly the same rate as asset growth, again an indication of less productive asset growth.

In conclusion, the focus in 2023 should be on improving your efficiency ratio, and this will be achieved by the revenue side of the equation, not simply reducing your expenses. Managing expenses is always important, but there are only limited gains available via expense reduction. Rather, focus on improving revenue. To do so, keep an eye on effective deposit and loan pricing, but more importantly, grow the average balances per household. We find that the strongest correlation with a strong efficiency ratio is high balances per household.

Bill Handel is general manager and chief economist at Raddon, a Fiserv company. Fiserv, Brookfield, Wisconsin, is a CUES Supplier member.