3 minutes

Recent actions from the GSEs eliminates risk of older floating-rate notes becoming fixed rate.

Read the first part of this article.

Originally utilized in 1969, LIBOR—the London Interbank Offered Rate—was officially adopted by the British Bankers Association in 1986 as a benchmark rate and has subsequently become the global standard for the rate at which banks lend to one another. LIBOR rates are set by banks daily, with each bank providing the estimated rate at which it expects to borrow funds at a series of maturities (as well as a variety of currencies, which has led to Euro and Yen LIBORs, among others).

The presence of such a robust interest-rate setting process led market participants to adopt LIBOR rates as the basis for a wide variety of financial products. Current estimates place LIBOR as the reference rate in over $200 trillion of active financial contracts in the cash and derivatives markets. LIBOR exposure can most commonly be found in the investment portfolios of banks and credit unions in the form of variable rate mortgage-backed securities and collateralized mortgage obligations.

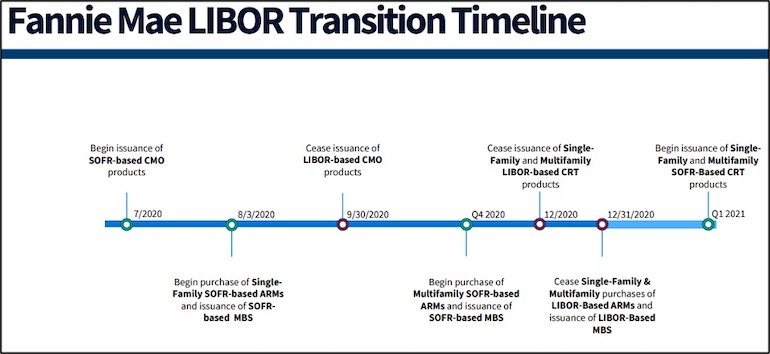

With no guarantee that LIBOR will continue to be published as of the end of 2021, global financial regulators have drafted plans to facilitate floating rates in the post-LIBOR world. In the United States, the Alternative Reference Rates Committee has chosen the secured overnight funding rate as the replacement for LIBOR, and in our previous article we discussed the differences between the two benchmarks and the challenges to a smooth transition. Fannie Mae and Freddie Mac have recently released a joint playbook and timeline outlining the LIBOR transition, which should help ensure a smooth transition from LIBOR to SOFR.

A key part of that timeline was the May 28 announcement that the government-sponsored enterprises formally adopted new LIBOR fallback language covering legacy floating-rate CMOs. These investments previously had no direct path to use SOFR as a replacement rate. This has eliminated the risk of legacy floating-rate MBS and CMOs becoming fixed-rate securities in the absence of a LIBOR rate.

Both Fannie Mae and Freddie Mac plan to begin issuing SOFR-referenced CMOs this summer and will cease issuance of LIBOR-based CMOs by Q4 2020. Additionally, both agencies plan to no longer offer LIBOR products or accept LIBOR-based collateral by the end of 2020. A significant outstanding item for Fannie and Freddie still to address is determining a replacement index for legacy LIBOR-based adjustable rate mortgages, and they have acknowledged the need to further clarify this transition.

While Ginnie Mae has adopted SOFR fallback language for new-issue securities as of March, the agency has not yet provided a path for legacy floating-rate securities to transition to SOFR. However, we expect Ginnie Mae to follow suit soon and provide market participants with its own version of a playbook.

One of the known issues with the SOFR index is the absence of a term-adjusted rate. The International Swaps and Derivatives Association has designated Bloomberg to publish compounded term rates to normalize the transition between term LIBOR and SOFR indices. Historical rates are available as of March 2 of this year. Unlike the forward-looking LIBOR term rates, these are backward-looking compound averages.

The Federal Financial Institutions Examination Council recently released a joint statement on the LIBOR transition and has provided some helpful guidelines for financial institutions to manage the LIBOR transition. Specifically, the supervisory activities section of the statement describes the items that examiners will evaluate during regularly scheduled examinations.

The Fed has complicated the LIBOR transition recently by retreating from using the SOFR index for transactions under the recently created Main Street Lending Facility and opting for LIBOR instead. Regardless, the timelines and playbooks recently released by the GSEs provide some clarity on the inevitable LIBOR transition and offer a clear path for credit unions when navigating the future of floating rates.

Peter Gibson is VP/chief investment officer and JD Pisula is VP/strategic advisory for Accolade Advisory, Columbus, Ohio.