3 minutes

Your strategic planning process is as important as the plan and should be ongoing.

Recently, Henry Meier, SVP/general Counsel at the New York Credit Union Association penned a blog addressing “Why D.C.’s Policy Pronouncements are the Key to Economic Growth.” In it, Meier discusses the shifting sands of today’s political environment, as well as the state of our economy and how “We are now more dependent on Washington than ever before.”

The business environment in which your credit union operates is, to say the least, complicated. Beyond the challenges that emerge from Washington, you are likely faced with growing competition, shifting demographics, technological disruption, as well as the potential for an economic slowdown or recession. What else would you add to your list? Challenges with board succession? A CEO transition? A core conversion?

How prepared is your credit union to meet these challenges? Do you have a solid strategic plan in place? What about your process? We think the process, in these turbulent times, is nearly as important as the plan.

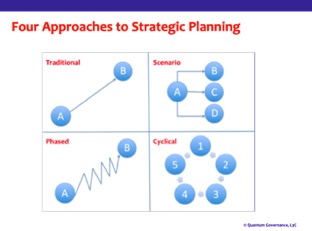

There are four common strategic planning processes that you and your colleagues can adopt:

A traditional planning process would have you identify where your credit union is today and where you want to be in the future (for example, three to five years from now). Then, you create a disciplined timeline, set of strategic goals, milestones, and financial and other resources needed to get there. The only problem with this process is that stuff happens. Presidents implement tariffs. Timelines for core conversions drag on. You get the point.

A traditional planning process would have you identify where your credit union is today and where you want to be in the future (for example, three to five years from now). Then, you create a disciplined timeline, set of strategic goals, milestones, and financial and other resources needed to get there. The only problem with this process is that stuff happens. Presidents implement tariffs. Timelines for core conversions drag on. You get the point.

Scenario planning allows you to plan for a number of different potential futures or scenarios on a contingency basis. The challenge here is that it’s much more time-consuming because of all of the time required to create and consider alternative scenarios (and accompanying plans)—many of which are sometimes necessary, particularly in an unpredictable world in which very different futures may unfold.

In phased planning, it’s understood that the world may change quickly and, therefore, it’s difficult to plan too far into the future. Accordingly, the phased approach tries to break up the strategic planning process into manageable periods (or phases) of time. The downsides to phased planning are that you can lose sight of longer-term goals and default to a form of operational planning.

Cyclical planning combines best practices from all three of the above methods—It’s “real-time,” “continuous” or “ongoing” strategic planning. To quickly put you at ease, cyclical planning does not mean that you are re-creating your strategic plan at every board meeting or even every year. What it does mean is an important change in the mindset of both your board and your management team. It means that strategic planning is regarded not as something separate from the board’s governing duties, nor is it separate from management’s responsibilities. It means that strategic thinking and planning are core elements of your board’s and management’s responsibilities.

It means, therefore, that your board and management are holding meaningful strategic discussions on an ongoing basis—throughout the entire yearly cycle of board and committee meetings. (And that these discussions go beyond merely an update on how you are doing on the metrics.) It means there is no designated start and end to “the plan.” It is thoughtfully considered—and modified if need be—over time.

It means that as the sands shift in Washington, China or in your backyard, your credit union’s board and management team are prepared to react—quickly and in “real time” to meet the credit union’s changing strategic needs.

Michael Daigneault, CCD, is CEO of Quantum Governance L3C, Herndon, Virginia, CUES’ strategic provider for governance services. Daigneault has more than 30 years of experience in the field of governance, management, strategy, planning and facilitation, and served as an executive in residence at CUES Governance Leadership Institute.

Jennie Boden serves as the firm’s managing director of strategic relationships and a senior consultant. She has 25-plus years of experience in the national nonprofit sector and served as the chief staff officer for two nonprofits before coming to Quantum Governance.