3 minutes

This analysis answers the key question: If plan assumptions prove overly optimistic, how much of your earnings and net worth are at risk?

By definition, strategic planning and financial forecasting require making assumptions about the future. However, common sense tells us that the future seldom unfolds as expected. Therefore, a well-developed business plan and forecast should address that inherent uncertainty head-on by explicitly identifying important assumptions and by quantifying the financial impact if those assumptions prove to be inaccurate.

Scenario analysis is an indispensable tool for addressing the risks and uncertainties inherent in forecasting and business planning. By linking major risks and uncertainties to key variables in the financial forecast, scenario analysis enables management to quantify the impact of those risks by using an alternative set of assumptions about the future (i.e., by changing key variables).

At the most basic level, scenario analysis answers the key question: If the plan assumptions prove to be overly optimistic, how much of the institution’s earnings and net worth are at risk?

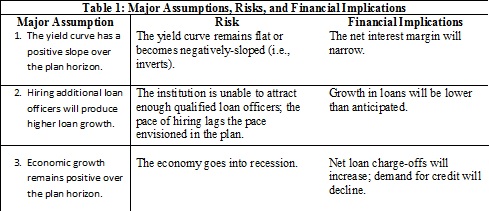

Identify Major Assumptions, Risks, and Financial Implications

Scenario analysis does not need to be complex to be effective. Once the plan is formulated and the financial forecast is developed, it is important to identify the major assumptions that underly the plan and the forecast. It is equally important to identify the risks associated with those assumptions and the financial implications posed by those risks. A simple example illustrating this approach is presented in Table 1.

Note that major assumptions may pertain to either the external environment in which the credit union operates, or to specific initiatives unique to an institution’s strategy. Therefore, assumptions deemed to be major may vary by institution. For the analysis to be truly meaningful, it is important that the focus be on only those assumptions found to be the most critical to achieving the goals set forth in the plan (i.e., that pose a material financial impact to the forecast).

It is crucial that the interrelationship between major assumptions, risks and financial implications are documented. Doing so fosters transparency regarding key assumptions and provides a basis for the executives and the board to debate the reasonableness of the assumptions. When done properly, this approach provides a logical framework for subsequently developing an alternative financial scenario using a more conservative set of assumptions.

An Example of Scenario Analysis

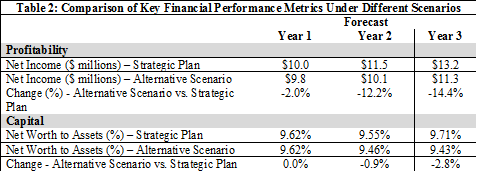

Assume that a hypothetical credit union has developed a strategic plan and an associated financial forecast, which we’ll call the strategic plan forecast. In light of risks to the major plan assumptions outlined above, the financial impact of those risks can be quantified by changing a few key financial variables in the strategic plan forecast: reducing the net interest margin via a lower assumed yield on earning assets, lowering assumed loan growth, and increasing the anticipated rate of net charge-offs.

Collectively, these changes constitute an “alternative scenario forecast.” A summary of the key results of the two scenarios should be complied and compared. An example is provided in Table 2.

As the alternative scenario reflects more conservative assumptions than those used in the strategic plan forecast, the difference in the financial results between the two scenarios serves to quantify the impact of the risks that arise from the difference in plan assumptions. The analysis helps management and the board gauge the magnitude of change in financial results if certain key assumptions prove to be inaccurate.

If the major risks and associated financial implications are properly identified, it is not necessary to conduct more than one alternative scenario. Also, while the comparison in this example focuses on earnings and capital, other metrics could be incorporated. However, the power of the comparison is enhanced when it is limited to a few key performance metrics that align with the strategic priorities of the institution.

Uncertainty and risk are inherent to businesses planning. Effective planning requires that major risks be identified and that their potential financial impact be quantified. Scenario analysis provides a simple but powerful methodology for addressing uncertainty and should be viewed as an integral component of business planning.

Claude A. Hanley, Jr., is a partner with CUES Supplier member Capital Performance Group, LLC.