4 minutes

More and more financial institutions are helping to finance a low-carbon, resource-efficient and socially inclusive marketplace. Is your credit union ready?

What is the first thing you think of when you hear the word “green”? A forest? A frog puppet? A dollar? A recycling box?

How about the economy?

According to the United Nations Environment Programme, a green economy is low-carbon, resource-efficient and socially inclusive. Here’s a cheat sheet:

| What It IS | What It ISN'T |

| Low-carbon | Wasteful |

| Socially just | Polluting |

| Circular | Linear |

| Resilient | Inequitable |

| Ecological | Concentrated |

| Beneficial | Fragile |

| Distributed | Disconnected |

| Diverse | Toxic |

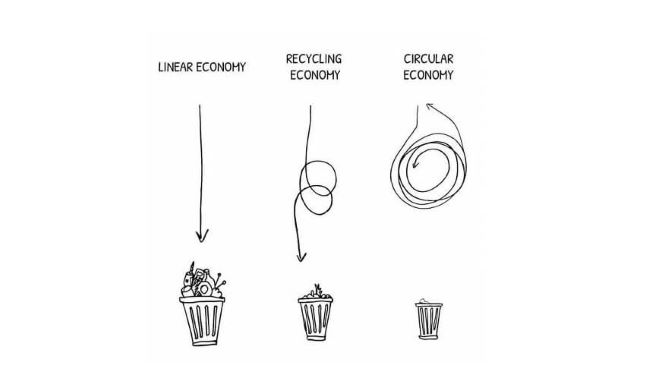

A green economy is not linear. You have probably heard of a circular economy, which keeps materials, products and services in circulation for as long as possible; a green economy encompasses those same principles. Instead of traditional “take-make-waste” models, green economies are built on circular models that maximize resource use and reduce waste.

In addition to being circular, low-carbon and climate-resilient, a green economy is also socially inclusive and strives for human well-being and ecosystem resilience.

It’s the Journey, Not the Destination

Determining whether an economy is green isn’t an either/or thing. It’s a spectrum. The goal is to keep moving toward a greener economy and to take action that moves us in the right direction. While climate change often receives a lot of attention in these discussions (rightfully so!), and a green economy is certainly one in which climate risks are factored in, other issues must also be considered. Below is a (non-exhaustive) list of indicators that can be used to track progress toward a greener economy:

- Greenhouse gas emissions

- Jobs (stable, personally fulfilling)

- Economic input/output (efficiency)

- Pollutant levels

- Waste reduction, diversion

- Circularity

- Social connections

- Biodiversity

- Water use

- Diversity

- Energy efficiency

Opportunities for Credit Unions in the Green Economy

Research shows that there are many opportunities for organizations that help to finance the green economy … and many risks for organizations that don’t.

Opportunities for credit unions include:

- Attracting and retaining talent. People increasingly want to work for companies that do good things. While the war for talent is on, do good (green!) things to attract good people. And grab an ESG (environmental, social, governance) analyst while you can, the demand for their skills is growing!

- Attracting members/investors. Investing in the green economy can help attract members and investors who want competitive returns while also benefiting society and the environment. As more and more businesses adopt ESG principles, there is an opportunity to generate financing and advisory services that help members meet their objectives. Many banks are positioning themselves as experts in these fields (e.g., climate change, the circular economy, the green economy) to show that they can help members operate in this space.

- Reducing operational costs. Taking the time to capture resource efficiency and other green economy metrics can reveal opportunities for improvements that have direct cost savings (e.g., energy, chemical, or water use) to your credit union.

- Offering new products and services. The transition to a green economy creates an opportunity to offer new products and services (e.g., green home loans, EV financing, green savings accounts with green investments).

- Building resilience. A green economy is a resilient economy. The COVID-19 crisis has highlighted the risks associated with geographically dispersed value and supply chains and linear models. There’s an opportunity to transition to more circular systems as we recover. A re-design aligned with the principles of the green economy has the potential to build in “circuit breakers”; for example, shortening value chains and onshoring production could increase supply security.

- Offering superior risk-adjusted returns. There may be an opportunity for better financial performance. For example, early data suggests that funds with a circular economy focus perform percentage points better than their Morningstar category benchmarks.

Risks include:

- Physical risks. A recent report from Ceres found that more than 60% of all U.S. credit unions are at risk from climate change, being physically located in vulnerable locations with increased probability of extreme weather events (e.g., floods, forest fires, droughts, etc.). Financed assets are also at risk, at least $1.2 trillion worth, according to the same report. Having a good understanding of how physical risks affect you and your members will help identify opportunities to mitigate them.

- Technological risks. Technological improvements and innovations (e.g., electric vehicles, bio-based plastic) will play a key role in the transition to a green economy. Winners and losers will emerge as new technology replaces old technologies, and this can have impacts on financial institutions, for example by increasing the risk of stranded assets.

- Regulatory risks. Changes in policies and regulations that aim to encourage the transition to a green economy (e.g., new reporting and disclosure requirements, carbon tax, plastic bans, toxic chemical regulations) can have a financial impact.

- Risk of being left behind. Momentum is growing in this field, with an increasing number of financial institutions taking action. Organizations that do nothing risk being perceived as laggards as the landscape continues to shift.

Garrett Jones is director/sustainable finance; Ben Clark is director/green economy; and Isla Milne is senior analyst with Delphi Group.