4 minutes

If you feel like there’s room for improvement in engaging younger people, consider these key questions.

Targeting younger members is so common that you could say it’s ubiquitous, but the reasons why are often fuzzy. Gaining traction with this group in a way that benefits both younger people and the institution requires more than good marketing and growth in the desired age group. It requires well-articulated reasons for why they are being targeted, along with a clear definition of success. Knowing what the institution hopes to accomplish makes it more measurable and provides guidance for how to home in on success.

A common reason for targeting younger members is because the customer base is aging, and younger people are needed to fill the pipeline for the future. Simply bringing in a lot of new younger members clearly won’t help the institution if they’re mostly inactive, so dig deeper with some questions to help define success:

- How young are we targeting?

- What business do we expect from this group?

- When do we expect this group to start being active or profitable?

What Does the Data Say?

Are those young folks really filling the pipeline? Use your data to answer relevant questions that challenge underlying assumptions. For people who became members at your targeted ages five or 10 years ago:

- What percentage are still members?

- What percentage are active members?

- What products and services are the active members using?

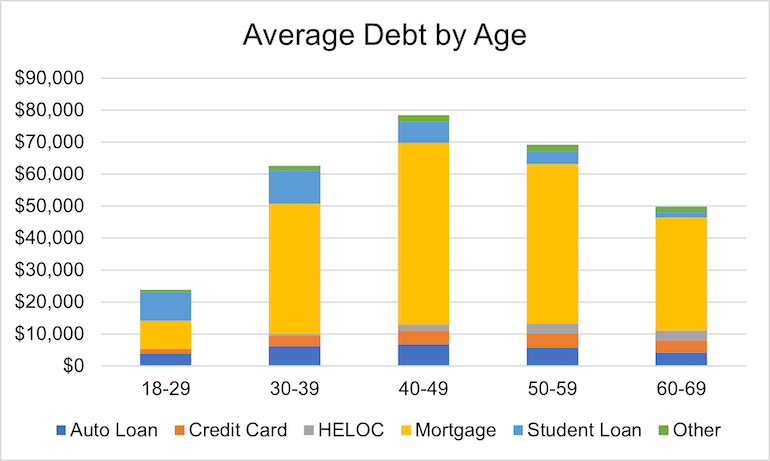

Even if the data doesn’t show the trends you want, it doesn’t necessarily mean abandoning the idea of targeting younger people. It could change how you strive to keep them engaged until they need other products and services. Industry data shows that the highest lending balances are held by people in their 40s. Looking back at when those members started with you and what their paths have been can also be enlightening. The same can be done for those who hold deposits, mortgages or other products and services you desire.

3 Key Questions

If you feel like there’s room for improvement in engaging younger people, consider these key questions:

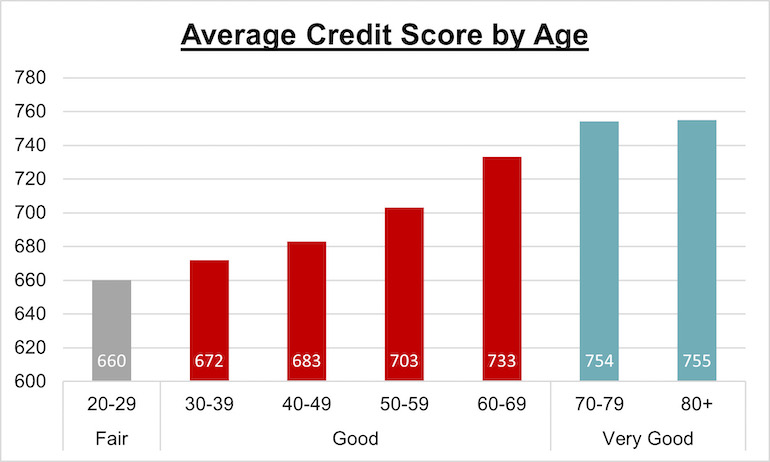

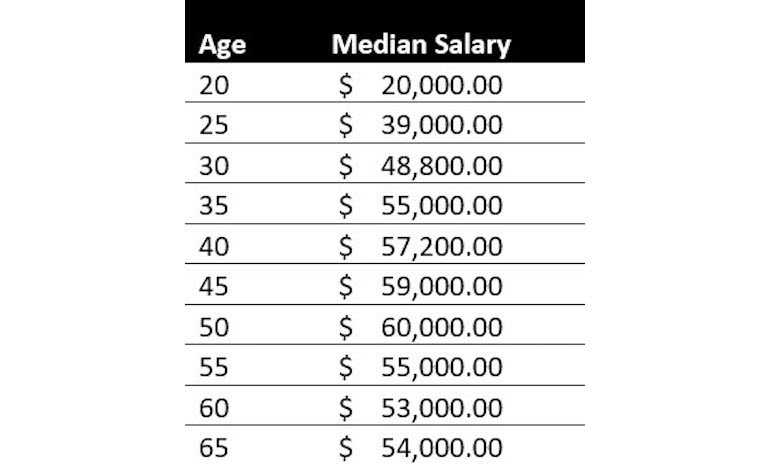

1. Do you have a good understanding of what their lives are like? The financial lives of younger people carry certain challenges associated with their age. Common challenges include credit scores that are lower on average, more student debt than previous generations, and starter salaries. Many fear they will never be able to own a home.

Here are a few data points to illustrate:

Do you want to target the typical young person or are you actually looking for a younger person with the credit profile of an older person?

Some say that young people aren’t loyal, but many haven’t been given a reason to be loyal. Helping people accomplish their goals, especially when others won’t, is a golden opportunity. All of this should be connected to your appetite for risk.

2. Do your products and services meet their needs, and do they resonate? View your products and services through the lens of their lives. Asking questions to learn from younger people can be helpful and it doesn’t have to be a big project.

Consider what changes you could make. How can you clearly illuminate a path for home ownership or getting debt under control? Even the names of products and services make a difference. How well does the purpose or label of share drafts resonate? How long will it be before no one knows what a checking account is? As an example, non-traditional competitor PayPal doesn’t talk about a “payment account.” They lead with, “Shop. Send. Manage.”

3. Do they know you’re meeting their needs? Step back and inventory how you are silently supporting their way of life, even if they don’t know it. If you have first-time car and home buying programs; pay available before payday; buy now, pay later; credit building; and other programs that hit the mark, make sure they know about it.

Bringing value to the lives of younger people is the foundation for filling the pipeline for the future. Having a clear understanding of your definition of success and monitoring to see how you are delivering value over time can help gauge progress and guide you forward.

Adding younger members and helping them develop good financial habits can be a great way to set the members and the credit union up for longer-term success. If good relationships with the younger members are developed over time, their use of the institution’s services over time is likely to increase. There is a greater chance that they will have both higher incomes and a greater need for a broad array of financial services.

C. myers helps financial institution decision-makers uncover opportunities and continuously optimize their business models. Their depth and range of experience in linking strategy, talent, desired financial performance and successful execution enables them to work with their clients as strategic collaborators. They have the experience of working with over 600 financial institutions, including 200+ of those over $1 billion in assets. C. myers helps financial institutions think to differentiate and drive better decisions through strategic planning & business model optimization, strategic solutions and implementation, strategic leadership development, real-time ALM and financial forecasting, education, and thought leadership.