4 minutes

Credit union leaders identify four key themes in improving the member experience.

During a recent credit union lending conference keynote, I offered up the idea that we–for the remaining hour–retitle the meeting the “Borrowing Conference” as a way to provide focus on the member. It made for a stimulating dialogue as we concentrated on the member experience in borrowing-lending. In the end, crafting easier experiences for members was significant in improving the member experience and allowing for more loan growth.

Several dozen credit union leaders from all states offered their views on improving the borrowing experience. Truth be told, the elements of a successful borrowing experience extended to other member experiences. In general, four themes emerged: go digital; listen to your members; the easy way is the only way; and stay true to the credit union service model. Let’s explore.

1. Go Digital

“Ink pens around the industry are drying up,” shared one CEO, “and that’s just the way our members like it.” From research to application to underwriting updates to approval to signing to service, the message is clear: Members expect the entire borrowing experience to be mobile.

“We accepted that our credit union is a retail business with high retail expectations from our members,” shared a senior lending executive. “If our members can check in for a flight and order a room service sandwich for lunch before landing, they anticipate the same access and experience with every retail business, including ours.”

For these credit unions, self-service is the foundation for member service.

2. Listen to Your Members

An attention-grabbing slide found its way into a PowerPoint deck cited data that 80 percent of executives think their businesses deliver an outstanding consumer experience while 8 percent of consumers answer the same.

To discover how to close that perceived gap, many credit unions utilize member participation and feedback in their design, testing and refinement of member experiences. This end-user model is valuable: the best source of information about a new or existing experience is the member. Constant, real-time feedback allows for continuous refinement, incremental innovation, and an ear-to-the-ground process that listens, learns and acts from the wisdom of those served.

3. The Easy Way Is the Only Way

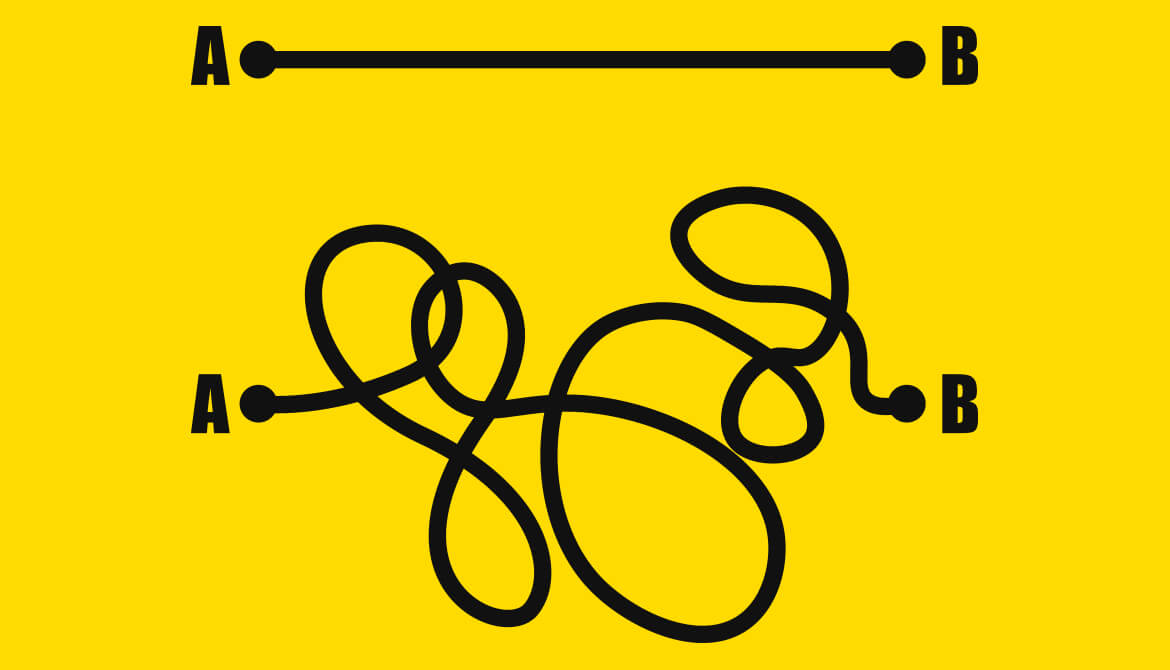

Historically, the borrowing process can be inconvenient, drawn out, and stressful. Much industry research has shown that the best predictor of repeat business and increased spend is “ease of doing business.”

To this end, a number of credit unions began asking, “How can we create as few steps as possible; approve in-branch as quickly as indirect; work ‘members’ hours’ rather than just 9 a.m. to 5 p.m.; and think through the member’s eyes?”

Through journey and empathy mapping processes, these credit unions understood where processes and experiences started, slowed, abandoned and ended. A chief experience officer summed it up best, “Until we figured out our inconvenience—and took the hard, but necessary steps toward greater ease and convenience—we were losing opportunities to serve our members and grow.”

4. Stay True to the Credit Union Service Model

As quickly as members are moving toward omni-digital status—and as much as the cost accountant and efficiency aficionado in all of us loves self-service—not all experiences are digital. Some models and communities lend themselves to a more “high touch” standard of service. Some loan requests can’t be auto-decisioned; they’re “character” loans. And, some experiences require a human voice, face and mind to reason through matters of financial importance.

“We’re dealing with people’s lives, families, and financial resources. All are intertwined and incredibly important to the member,” shared a COO. “We want our members to use technology—and our members will use it as necessary—but not at the expense of providing service, delivering an experience and expanding a partnership with the credit union they own.”

A picture that comes to mind is the well-known credit union logo and image of two hands holding a globe and caricatures of people. The depiction has been used around the world and continues to represent the philosophy of “people helping people.” While the illustration may appear outdated, the message continues to remain pertinent. An up-to-date refresh on the logo might position a mobile phone in one hand while the other supports the value of the credit union philosophy and model. And, it just may capture the essence of the member experience: a balance of digital and personal, both supporting your credit union’s vision of service to all members through all phases of life.

Jeff Rendel, CSP, is president of Rising Above Enterprises, works with credit unions that want entrepreneurial results in sales, service and strategy. Each year, he addresses and facilitates for more than 100 credit unions and their business partners. Reach him at 951.340.3770.

If you liked this post, you might want to attend the CUES School of Member Experience ™, Sept. 10-11 in Denver.

Rendel will present "Trendspotting--What to Deliver Today for Success Tomorrow" at CUES' Directors Conference in December.