10 minutes

It’s worth it to push back against any pushback so you can fully embrace (and reap the benefits of) diversity in your membership and staff.

Many people in the credit union movement like to talk with pride about how today’s credit unions were founded on the principle of serving people “of modest means” who might not have been able to get financial services elsewhere. Many would say that credit unions are all about financial inclusion and the diversity of membership and staff that supports it.

Yet today there are reports of pushback in the credit union world against making changes to traditional practices to transform credit unions into good servants and employers of people from growing demographic and traditionally marginalized groups—against what has most recently been called diversity, equity and inclusion.

This pushback is happening even as data shows that businesses in general and credit unions in particular reap business benefits from being more inclusive.

This pushback is happening even as the media and big banks continue to try to make the case that credit unions should no longer be tax-exempt—because they are getting “too big” in asset size (the largest banks still dwarf the largest credit unions) and because, they say, credit unions aren’t doing a good job with financial inclusion, whether that’s in the handling of lending or overdraft fees.

Take a few minutes now to look at some data and hear what people who spend a lot of time thinking about these matters have to say about the business case for DEIB, the pushback against it and what credit unions should do next.

DEI Builds Financial Strength

Credit unions that pursue multiple DEI best practices see financial benefits, according to research done by Filene.

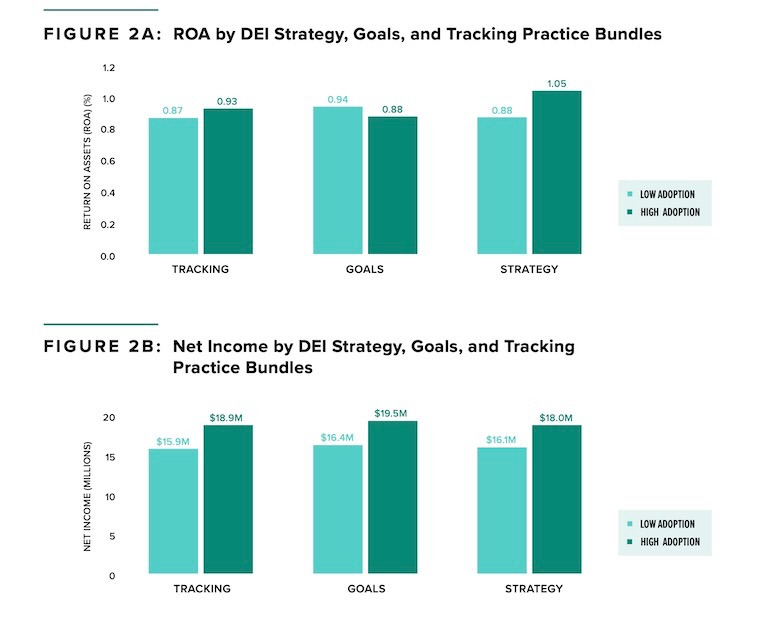

The study, DEI Practice Bundles & Credit Union Performance: Results from Filene’s DEI Practices & Policies Survey, 2022, found that “credit unions with (a) DEI [diversity, equity, inclusion] strategy and governance practice bundles report higher return on assets and net income than credit unions without these practice bundles in place.” See figures 2A and 2B for details. (The research defines “bundles” as groups of practices, especially those that link DEI to strategy.)

In addition, a 2020 report from McKinsey companies across industries—not just credit unions—benefit financially from DEI.

Specifically, the report says, “Companies in the top quartile for racial and ethnic diversity are 35% more likely to have financial returns above their respective national industry medians. It also found that “companies in the top quartile for gender diversity are 15% more likely to have financial returns above their respective national industry medians.”

The Business Benefits of Pursuing Belonging (Bolstered by Pursuit of Equity)

In recent years, many organizations have added a B for belonging to DEI, making the acronym DEIB. Growing amounts of data support the idea that businesses in general and credit unions in particular benefit from efforts to make employees feel that work is a place of belonging for them.

For example, research published in the Harvard Business Review in 2019 found a clear link between employees’ sense of belonging and a thriving business organization.

Evan W. Carr, a quantitative behavioral scientist at performance management firm BetterUp, and his team found that “if workers feel like they belong, companies reap substantial bottom-line benefits. High belonging was linked to a whopping 56% increase in job performance, a 50% drop in turnover risk, and a 75% reduction in sick days. For a 10,000-person company, this would result in annual savings of more than $52M.

“Employees with higher workplace belonging also showed a 167% increase in their employer promoter score (their willingness to recommend their company to others),” the research report continues. “They also received double the raises, and 18 times more promotions.”

An inexpensive but effective way to strive to help all employees feel a sense of belonging and like they’re being treated equitably is to ask them about where things are now and what they would recommend doing next.

CUES member Emma Hayes, chief learning & engagement officer of $49 billion SECU, Raleigh, North Carolina, recommends “a serious listening strategy” that encompasses listening both to employees and board members (who are both internal team members as well as members of the credit union and community). She suggests a combination of one-on-one sessions, small focus groups and surveys.

Ask three questions, Hayes says:

- What are we doing that you really, really love—the thing that would mortify you if we stopped doing it today?

- If you could launch any product or service at the credit union, what would it be?

- Is there anything else we could do to better serve you?

Then be sure you do something with the responses, Hayes advises.

“If you don’t follow through there’s no need to ask,” she emphasizes, noting that not everything that’s suggested may be doable nor can everything happen at once. As acknowledgement of the responses and preliminary steps is given, a good thing to say can be: “We’re not there yet but we heard you.”

Using Assessments to Show Opportunities With Diversity and Inclusion

As CEO of Coopera (kо̄-PAIR-a) Consulting, Victor Miguel Corro helps individual credit unions think about how to expand their reach within their existing communities—often a great business opportunity. He does so by helping them assess both their fields of membership, so they can see how many members and potential members they’re not serving fully as well as their organizational readiness to embrace DEIB.

Oftentimes, Corro finds through these assessments that a credit union client is not fully serving people who have been traditionally underserved, such as Black and African Americans, women and Hispanics. While credit unions might not yet have a lot of experience serving members who are part of these groups, there can be lots of business value in learning how to do so.

“That’s a younger population, an emerging population and a largely unbanked population,” Corro notes of the Hispanic community.

Research from Pew supports this idea: “The median age of U.S. Hispanics increased from 26.3 years in 2010 to 29.5 years in 2021. Yet they remained much younger than the overall U.S. population, which had a median age of 37.8 in 2021.”

So, discovering that you have Hispanic people in your community that you could serve and taking action to try to serve them well opens an opportunity to establish relationships with highly coveted young consumers, Corro points out.

Another group that presents a business expansion opportunity for credit unions is people in their fields of membership who don’t have Social Security numbers from the Social Security Administration but do have individual taxpayer identification numbers from the Internal Revenue Service.

Research published by Filene in May 2023 included a conversation with a credit union that shared its four-year journey lending to people with ITINs and how it grew its ITIN portfolio from $640,000 in 2019 to $5.3 million in 2022.

The authors of the same report write, “Fair lending practices should encourage credit unions to offer ITIN loans with the same underwriting, interest rate scales and documentation requirements with no additional fees. Most credit union leaders we interviewed shared they experience zero to very minimal delinquencies and net charge-offs when implementing the same lending practices as traditional loans.”

And of course, looking to serve new markets returns the conversation to who on the team at the credit union can do a good job in doing so. Credit unions may need to hire some new people who understand the new members the credit union is trying to reach—or to update the training for current staffers. Alison Carr, CUDE, I-CUDE, and Scott Butterfield, CCUE, CUDE, of Your Credit Union Partner provide a great summary of the many potential business benefits of having a diverse staff.

- Drives growth. A diverse team enables the credit union to better understand, reach and better serve diverse consumers.

- Enhances the member experience. Having staff members who reflect the diversity of the community tells your members and potential members that you see them and that they are more likely to be treated equitably.

- Improves employee engagement. Having a culture where you can ask questions, promote learning and exchange of ideas and welcome different experiences drives employee engagement.

- Improves financial performance. Building diversity on the credit union’s team can help create more diverse thinking, which in turn can yield better decisions and a positive bottom-line impact through increased efficiencies, productivity, creativity and innovation.

And those ideas circle back again to the business benefits of operating inclusively.

Inclusion efforts “shouldn’t be just about the bottom line, Inclusion is what sets up apart.” Hayes says. “It’s the only way for us to argue for our tax exemption. If we become member elite organizations, we’re no longer credit unions, people helping people.”

What Does Pushback Look Like—and What Can Be Done About It?

While the data in support of the business case for diversity, equity and inclusion is growing, pushback against taking action to boost DEIB in credit unions is real. What does such pushback look like, and what can credit unions do about it?

“Pushback looks like questioning—not curious questioning, but leading questioning,” Hayes says. These questions might sound something like “Tell me why this …” or “Can you help me understand why we would invest that kind of time, that kind of money …,” or “Is that the best use of so and so’s resources?” “Some pushback is really, really subtle.”

Pushback can also come in the form of withholding of resources, Hayes says. The first answer to a request for resources for staff or member inclusion efforts might be “yes.” But if feet drag and funds are slow to arrive or never arrive, that’s pushback.

Corro says credit unions can also experience pushback when legacy members come into a branch and demand to know why the credit union is, for example, putting out marketing messages clearly designed for people who speak Spanish.

“You actually have to train people to anticipate this” sort of thing, Corro says. While a challenge from a member isn’t the norm, front-line staff need to “know to say, ‘We’re doing it because we want to serve the whole community, and it makes the credit union stronger … and so we can better serve you …” or ‘The Hispanic or African American segments of the population are growing in the community, and we want to include them so we have a better community.’”

Besides training staff, what can credit unions do to better grapple with pushbacks?

“More conversation, whitepapers, research to show the economic benefits will help with this,” say Carr and Butterfield. “For example, we have a few boards that push back on ITIN lending because they don’t want to serve non-U.S. citizens. However, when they see the Filene report and see the profitability, growth and loyalty results from immigrants, most change their perspective about DEI.” A vision the two have for the CU DEI Collective is that the organization can be a leader in helping to generate information that can drive inclusion forward.

Getting away from politicizing conversations about inclusion will likely be helpful too.

“We travel the county for strategic planning sessions,” Carr says. “We are in blue states and red states. … It’s clear that DEI is more widely embraced in blue states. However, there are still credit unions in red states that are actively pursuing DEI. More work needs to be done to overcome the negative political narrative to educate boards and management that DEI is a proven differentiator.”

Corro, Hayes, and Carr and Butterfield all say the need for inclusion—of diverse members, of diverse employees—is not a passing fad, but here to stay. Here are Carr and Butterfield on the subject:

“The demographic changes in communities are clear. Credit unions that do not embrace DEI will at some point become irrelevant in the diverse communities they are chartered to serve. They will fail to attract the diverse talent they need to grow. It might take a while, but change will be required. Plus, the next generation that credit unions are all focused on engaging are very diverse, and they place a high value on social responsibility and DEI.”

Lisa Hochgraf is CUES’ senior editor.