3 minutes

Clarify your intentions and generate a well-informed approach to AI using these six questions.

Excerpted and adapted with permission from Generative AI: Credit Union Values, free for download.

In credit unions’ strategic positioning regarding the use of generative artificial intelligence, credit union members and staff leaders must address a series of key questions to clarify their organizations’ intentions and ensure a well-informed approach.

“Members trust credit unions, and the eight guiding principles are fundamental to building generative AI use cases,” notes Susan Mitchell, CEO of Mitchell Stankovic & Associates, Boulder City, Nevada. “We must ensure credit union values are preserved, and that requires all leaders to engage in creating a generative AI strategic road map.”

Use these six questions from Generative AI: Credit Union Values to guide your efforts.

1. Why Are We Considering Generative AI?

Our motivation for considering generative AI should be clear. Are we looking to enhance member experiences, optimize operational efficiency, or achieve specific business objectives? Understanding our primary goals will guide our implementation strategy.

2. What Problems Are We Looking to Solve?

Generative AI should be a solution, not a solution in search of a problem. It is essential to identify the specific challenges or opportunities we aim to address using generative AI. Whether it is improving customer service, automating processes or generating personalized content, defining these problems is crucial.

3. Do We Have the Talent and Budget to Implement and Run Artificial Intelligence?

Implementing and maintaining generative AI requires a skilled team and adequate financial resources. We need to assess whether we have the necessary talent in-house or if we need to hire or partner with external experts. Additionally, we must evaluate our budget to ensure we can sustain this technology effectively.

4. What Will Success Look Like?

We must define clear success metrics and benchmarks to gauge the effectiveness of our Generative AI implementation. Success could be measured through improved member satisfaction, cost reductions, increased revenue, or other key performance indicators aligned with our goals.

5. What Are the Benefits?

Understanding the potential benefits of generative AI is crucial. We need to identify how this technology can positively impact our operations, members, and business outcomes. These benefits could include efficiency gains, better member engagement and competitive advantages.

6. What Are Our Risks?

Generative AI implementation carries risks such as data privacy concerns, ethical implications, and technical challenges. We should identify and assess these risks and develop strategies to mitigate them effectively.

By answering these questions, we can establish a clear and well-informed strategic position regarding the use of generative AI. This clarity will guide our decision-making process and ensure that our approach aligns with our organization’s objectives and resources.

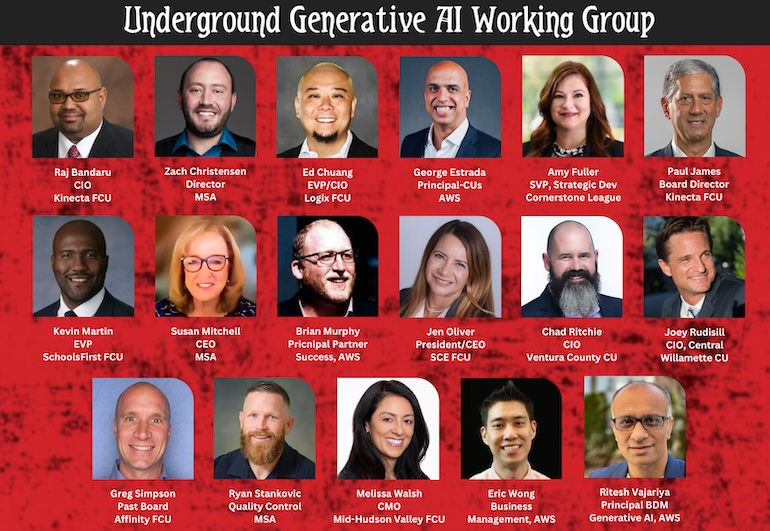

The contributors to the Underground/Mitchell Stankovic report are: CUES member Raj Bandaru, CIO, $6.7 billion Kinecta Federal Credit Union, Manhattan Beach, California; Zach Christensen, director DEI/digital services, Mitchell Stankovic & Associates, Boulder City, Nevada; Ed Chuang, former EVP/CIO, Logix Federal Credit Union, Santa Clarita Valley, California; George Estrada, principal strategic advisor/credit unions, Amazon Web Services; Amy Fuller, SVP/strategic development, Cornerstone League; CUES member Paul James, board member, Kinecta FCU; CUES member Kevin Martin, CCE, EVP/strategic integration and member experience, $28 billion SchoolsFirst Federal Credit Union, Santa Ana, California; Susan Mitchell, CEO, Mitchell Stankovic & Associates; Brian Murphy, principal partner success manager/nonprofits, Amazon Web Services; Jennifer Oliver, CCE, president/CEO, $1 billion SCE Federal Credit Union, New York; CUES member Chad Ritchie, CIO, Ventura County Credit Union, Ventura, California; CUES member Joey Rudisill, CCM, CIO, Willamette Credit Union, Albany, Oregon; Greg Simpson, past board director, Affinity Federal Credit Union, Basking Ridge, New Jersey; Ryan Stankovic, director quality assurance, Mitchell Stankovic & Associates; CUES member Melissa Walsh, CCE, SVP/CMO, $1.4 billion Mid-Hudson Valley Federal Credit Union, Kingston, New York; Eric Wong, business management/global healthcare & nonprofit, Amazon Web Services; and Ritesh Vajariya, principal business development manager/generative AI, Amazon Web Services.