5 minutes

Follow a defined process to address the most concerning risks and their effects on financial performance.

Strategic plans are all about possibilities, but the possibility of risks getting in the way is also part of the equation. Knowing that there are risks and knowing that they can impact financial performance means that choices must be made. Those choices are better made after reaching as much clarity and alignment as possible, especially in a changing or uncertain environment. Stakeholders who follow a defined process to address the most concerning risks and their effects on financial performance have more clarity and confidence in how resilient their plans are and whether they need to be adjusted.

Step 1: Agree on Risk Appetite and Current Level of Risk

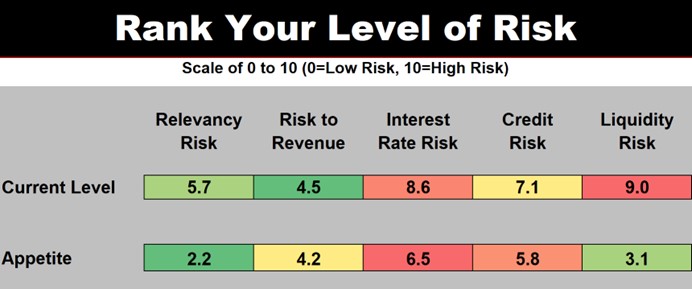

This step not only allows decision-makers to articulate their appetite for different types of risk but also fosters alignment around how much risk is present. Start by identifying your major areas of risk, then determine how much risk various stakeholders are comfortable with each area and how much risk they perceive the institution has taken on. This is a targeted way to uncover where risk appetites and perceptions of current risk diverge so they can be brought out for discussion. The value is in the conversation, which typically leads to better alignment.

In this example, each team member was asked to rate their appetite for and perceived current level of risk on a scale of 0-10 for each category. Here, we’re showing the average of the team’s rantings. The team’s appetite for risk to revenue is very close to the perceived current level of risk. Liquidity risk is a different story. Conversations can center on why the appetite for this risk is relatively low and why the perceived current level is high. It’s also helpful to discuss wide variations in individual scores, such as why one person believes the current level is high while another rates it low. See our blog, Linking Revenue Opportunities with Appetite for Risk, for more ideas.

Step 2: Ready the Strategic Financial Plan

Many organizations already have a longer-term financial view of the strategic plan, often called a strategic financial plan or financial roadmap. This is an important tool when balancing risk, strategy and financial performance. The plan looks out three to five years and provides a high-level financial view that builds upon the current structure and trends, plus layers on the financial consequences and timing of the strategy. This provides a view of the institution’s expectations for a likely scenario. The fact that none of us can accurately predict the future means that it serves as an excellent starting point but is definitely not set in stone. Rather, it is a valuable base for alternative outcomes or what-ifs for Step 3. See our blog, Why a Financial Roadmap is Important, for more information.

Step 3: Address the Highest Priority Risks

Armed with Steps 1 and 2, stakeholders can begin to address the risks that concern them the most. Questions for discussion include:

- What could we do (or what more could we do) to mitigate this risk?

- What are the costs or downsides of mitigation? How does mitigation impact the strategy?

- Is the risk already being addressed through the strategy or other means? What is the timeline for resolution?

- Is the organization on a path that will increase the risk? How much and how quickly?

- If the risk has not materialized yet but is a concern, how likely is it to materialize and when?

Example:

Risk Concern: Stakeholders are concerned about the level of credit risk in the loan portfolio because there is a possibility of recession.

Discussion: Stakeholders agree that the risk could be mitigated by pulling back on lending in the lower credit tiers. This will likely reduce interest income. It also impacts their well-known strategy to serve people with credit hiccups. There is alignment on the belief that if a recession comes, it will be in the following year and that it won’t be as severe or long-lasting as the Great Recession.

Financial Impact: Determine what a bad case credit loss looks like, using history as a guide, and run a what-if on the strategic financial plan with higher loss ratios in the timeframe discussed. Another what-if combines the higher loss ratios with lower loan volumes. There may be versions of less or more severe impacts.

Decision: The results make the tradeoffs clearer. Non-financial aspects are also discussed, including the impact on members. Stakeholders decide whether to keep the current loan volume goals and accept the risk of higher losses or accept lower loan volumes and lower income.

Using the strategic financial plan as a base, what-ifs illustrate what could happen to financial performance if risks are realized or mitigation actions are taken. Stakeholders can then have more complete information to base discussions and decisions on, which could include adjusting the plan. For insights on how to connect aggregated risks to strategic net worth, listen to our podcast, Maximizing Net Worth: Insights for Financial Institutions.

Risk evolves over time, so this process is not a “one and done.” Consider building in regular check-ins—revisiting risk questions periodically is appropriate and can help keep everyone on the same page.

This three-step process enhances clarity and communication between the board and management. It can help stakeholders get more comfortable with the directions the institution is taking and how it’s protecting against the most concerning risks. By connecting these dots, stakeholders are better able to balance their strategic path, risk tolerance and financial performance, boosting confidence that they’re making better-informed decisions.

c. myers helps financial institution decision-makers uncover opportunities and continuously optimize their business models. Their depth and range of experience in linking strategy, talent, desired financial performance and successful execution enables them to work with their clients as strategic collaborators. They have the experience of working with over 600 financial institutions, including 200+ of those over $1 billion in assets. C. myers helps financial institutions think to differentiate and drive better decisions through strategic planning & business model optimization, strategic solutions and implementation, strategic leadership development, real-time ALM and financial forecasting, education, and thought leadership.