5 minutes

Credit unions can lock in some value and protect themselves against a falling-rate environment.

This article is reprinted with permission from the original.

Many institutions have experienced significant increases in the value of their mortgage servicing rights assets this past year, making MSR hedging a timely topic.

MSR assets generally increase in value when rates increase due to slower prepayment speeds leading to higher projected servicing income. In fact, the coupon rates for many servicing books are so low that models don’t project any further decreases in prepayment speeds given a rise in rates! It seems likely that many MSR assets may have reached their terminal values with refinance activity grinding to a halt.

Simply put, there seems nowhere to go but down from here for MSR asset values. The good news is that depositories can lock in some of that value and protect themselves against a future falling-rate environment through MSR hedging. While no one knows when the current trend of rising rates will end, we do know that it won’t go on forever. Now is the time to consider your options and potentially create more stability around notoriously volatile MSR asset values.

Understanding Mortgage Servicing Rights Assets

When mortgage loans are sold, two cash flow streams are created: the loan principal and interest payments and the servicing fee payments. MSR refers to the right to service mortgage loans for a fee. The resulting asset value is a function of the projected future servicing fee payments.

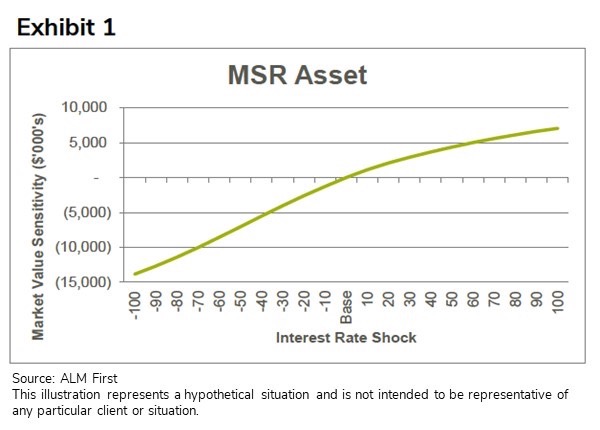

In addition to having a customer or member network, owning MSRs can be very attractive due to their high yields. However, MSR assets exhibit a great deal of price volatility even for small changes in interest rates and are often among the most volatile of assets on the balance sheet. Their high risk weighting in the risk-based capital framework of 250% also exhibits this fact. While MSR assets can offer significant returns on capital for institutions that have competitive advantages in servicing mortgages, their inherent price volatility makes hedging considerations very important.

MSR assets are very similar to interest-only strips on mortgage bonds. An IO strip is the result of splitting the interest and principal payments of a mortgage-backed security, and owners of these assets receive the interest portion of the payments of the underlying bond for however long the bond remains outstanding. Similarly, MSR assets grant the owner the stream of servicing fees over the life of the associated mortgages.

In terms of value, the longer the life, the better. If interest rates fall, however, more borrowers will likely decide to prepay their mortgages. IO prices decline substantially when the income stream is shortened with no offsetting principal effect. As with most mortgage bonds, MSRs tend to exhibit negative convexity, e.g., as interest rates decline, asset values decline at an increasing rate.

Evaluating Mortgage Servicing Rights Hedging Approaches

MSR assets are most commonly hedged with derivative positions. Exchanged-traded derivatives such as U.S. Treasury futures are often used, along with forward trades in mortgage-backed securities known as to-be-announced MBS trades.

Important to the success of any hedging program, the institution needs to ensure a sound framework is in place to evaluate risk. This includes having accurate measures of effective duration, partial (key rate) duration, convexity, and spread duration—essentially showing sensitivities to parallel shifts in rates, the slope of the curve and changes in spreads. Accurately quantifying risk allows the institution to create a hedge that offsets its risk.

As with most hedge programs, hedging an MSR asset is a dynamic, ongoing process. This means that once the risk has been identified and quantified, it needs to be regularly monitored. Given the volatile nature of MSR risk sensitivities (prepayment expectations play a big role in MSR pricing), the monitoring typically should be done daily, with hedge rebalances to maintain appropriate coverage as needed. Rebalancing events are typically prompted by some form of an updated sensitivity profile, which can occur via a change in underlying asset holdings or a change in interest rates. For example, rebalances can be performed when interest rates move outside a predetermined corridor; 20 bps or 25 bps moves are common, depending on the size and sensitivity of the exposure.

Final Thoughts

It’s important to remember that with MSR hedging there is no perfect hedge waiting to be discovered, but rather it is an ever-dynamic process requiring regular attention to reflect our current understanding. The goal of hedging is to protect losses in MSR value due to adverse market impacts, but these changes are rarely perfectly correlated. Typically, there are variations in asset correlation and even idiosyncrasies in the MSR valuation process itself. Measuring hedge performance can be done by referencing changes in asset versus hedge values, and statistical analysis such as R2 can be performed as well.

While MSR assets can be very profitable, being cognizant of the risks they present makes hedging a valuable option for many institutions. While hedging strategies have their own costs due to the complex models required, managers must have a sound analytical framework in place to effectively offset the risk. Done effectively, MSR hedging can protect an institution from capital losses and help maintain profitability during rate shifts.

Robert Perry is principal and Alec Hollis is managing director of ALM Strategy Group. Dallas-based ALM First is a CUES Supplier member.

ALM First” is a brand name for a financial services business conducted by ALM First Group, LLC (“ALM First”) through its wholly owned subsidiaries: ALM First Financial Advisors, LLC (“ALM First Financial Advisors”); ALM First Advisors, LLC (“ALM First Advisors”); and ALM First Analytics, LLC (“ALM First Analytics”). Investment advisory services are offered through ALM First Financial Advisors, an SEC registered investment adviser. Access to ALM First Financial Advisors is only available to clients pursuant to an Investment Advisory Agreement and acceptance of ALM First Financial Advisors’ Brochure. The content in this message is provided for informational purposes and should not be relied upon as recommendations or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

The content in this article is provided for informational purposes and should not be relied upon as recommendations or financial planning advice. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. While such information is believed to be reliable, no representation or warranty is made concerning the accuracy of any information presented. Statements herein that reflect projections or expectations of future financial or economic performance are forward-looking statements. Such “forward-looking” statements are based on various assumptions, which assumptions may not prove to be correct. Accordingly, there can be no assurance that such assumptions and statements will accurately predict future events or actual performance. No representation or warranty can be given that the estimates, opinions or assumptions made herein will prove to be accurate. Actual results for any period may or may not approximate such forward-looking statements. No representations or warranties whatsoever are made by ALM First Financial Advisors as to the future profitability of investments recommended by ALM First Financial Advisors.

© 2023 ALM First Group, LLC. All rights reserved.