5 minutes

Manage the rising cost of funds to be able to offer less expensive loans to members.

Credit unions in the U.S. have been witnessing a steady increase in membership since 2010. Average annual membership growth has been approximately 4 percent in the last four years. On the contrary, the deposit growth has shown a decline since Q3 of 2016. The deposit growth rate was recorded at 4.87 percent in Q3 of 2018 compared to 8.44 percent in Q3 of 2016.

Around 40 percent of U.S. credit unions have reported a decline in deposits in 2018, which amounted to approximately $3 billion on a year-over-year basis. (To find more about declining deposits, read “Are Credit Unions Over-Extended Again? Impressive loan growth, alarming deposit growth.”)

Focusing on increasing deposits is essential for sustainable and profitable growth strategies. With increases in the federal funds rate in recent years, achieving adequate deposit growth is the best way to manage the rising cost of funds. This allows credit unions to offer cheaper loans to their members using their own funds.

Here are three things that CUs can do to grow deposits.

1. Change the Deposit Product Proposition

Thinking of new and innovative deposit products has recently become essential. Redesigning existing products with new features can also do the trick, as it did for $480 million/28,000-member CBC Federal Credit Union, Oxnard, California. CU Rise helped it build EPIC Checking, a new product with a low monthly fee of $6-$8 and multiple money-saving benefits, including rebates on all debit card swipes, waived annual fee for EPIC rewards credit card, and better rates on deposits.

Within six months of the product launch, the program created strong interest among members. The CU saw a 20 percent conversion from the basic no-fee checking account to this premium account. The impact of the product launch on the credit union’s portfolio included the following:

- The average beginning balance for new accounts acquired through the new product increased by 50 percent compared to the older checking product.

- The low monthly fees helped the credit union earn an additional monthly income of about $50,000.

- The debit card swipes associated with EPIC Checking were up by 30 percent.

- The average monthly balances doubled compared to the older account. Total checking deposit dollars at CBC FCU are more than 15% higher this year.

2. Deepen Your Branch Network

Adding new branches helps credit unions expand their operations in new markets and attract new households and members, often adding to the deposits with CUs. However, for most credit unions, adding branches does not seem to be a priority. Based on NCUA call report data, the number of branches held by all credit unions was 21,830 in Q3 of 2017 and 21,874 in Q3 of 2018. Only 44 new credit union branches were added in a year.

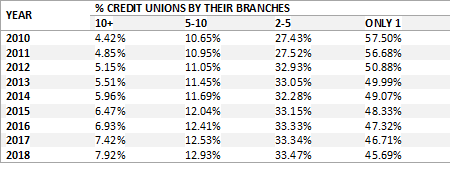

Bigger credit unions are getting bigger; smaller credit unions are either shutting down or getting merged into larger credit unions. The numbers in the table below clearly show this trend. The number of credit unions with more than 10 branches comprised 4.42 percent of total CUs in 2010 and 7.92 percent of all CUs in 2018, however the percentage of credit unions with only one branch and smaller operations is declining.

(Source: Compiled by CU Rise based on NCUA Call Report Data)

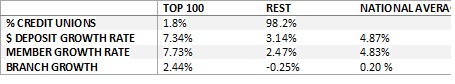

Based on NCUA call report data, 17 percent of the total credit union branches belong to top 100 credit unions. The deposit growth rate for these top 100 is 7.34 percent, 1.5 times more than the national average.

(Source: Compiled by CU Rise based on NCUA Call Report Data)

3. Formulate Competitive Marketing Offers

Thinking through marketing offers and offering them to the right members can accomplish a big win for credit unions. When the right offer is extended to the right member, it can entice the member to act, thereby improving deposit balances with credit unions. These offers can be made in a variety of ways, such as an introductory offer to new members where a joining bonus is awarded on a certain dollar deposits or a product bundling offer like one getting a fee waiver on credit card for on opening a checking account. Here credit unions can understand their members’ lifecycle, demographics, and transactional behavior to find the next best product for them. Identifying and forecasting a need for a deposit product at the right time for the member can help credit unions grow their balances.

Currently, many credit unions are introducing referral programs for member growth. On average, cost-per-acquisition for a member is about $100-$120 per new deposit account. Referral programs, often offer cash benefit of $50 for referring and $50 for new member account opening, are easier to execute than a cross-sell acquisition campaign.

Another way to keep deposit balances from diminishing is to keep members who are likely to leave the credit union. Sophisticated attrition models like the ones build by CU Rise can help credit union predict member attrition 11 times better than traditional methods. Re-engagement offers like providing free financial advisory services or monetary incentives on reactivation of their cards can go a long way in reviving relationships with lost members.

Suchit Shah is COO and Priyanka Pandya is senior consultant at CU Rise Analytics, Vienna, Virginia. CU Rise Analytics is a global CUSO helping credit unions leverage the power of data to better understand their members. CU Rise is a value driven, one-stop shop for detailed data analytics initiatives, best practices and advisory services.