4 minutes

The value of embedding financial experts in every department

Credit unions inherently differ from banks in that your primary mandate is service to members, rather than return to shareholders. This comes in the form of dividends, more competitive rates, lower fees and a myriad of member-centric offerings not available from a comparable bank.

A credit union’s status as a not-for-profit, cooperative organization belies the reality that the institution must sustain robust financial performance. This is the purview of the chief financial officer or some other senior finance/accounting executive.

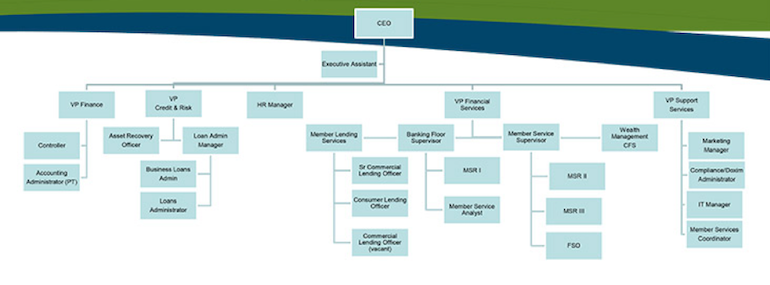

The typical large or smaller credit union organizational chart reveals a finance executive off to the side, isolated from other business and operations officers. We include the example below for simplicity. Clearly, a major credit union’s structure could be more complex than this example, but this chart provides a starting point for our discussion.

This structure is not much different from what you would find at many banks where the finance/accounting team operates in its own “silo” inside the organization. However, a new organizational structure has been implemented at many high performing banks over the last 10 years. It’s focused on the creation of positions that align with multiple departments in the bank. We believe that credit unions could also benefit from this organizational model.

Simply put, financial experts are embedded in various organizational units. Their primary role is to more closely align the finance team with day-to-day operations, support the gathering of information from which to make sound decisions, and then to act on the decisions made.

These financial experts report to the CFO, but align with the departments. They become an integral part of operations and business development including lending, mortgages, investments, credit cards and call center management, as well as support functions like IT. The role of these experts is to attend regular meetings across their assigned departments, with one eye toward the financial bottom line and the other toward optimal organizational performance. A keen understanding of business issues is vital to this job description.

One might assume introduction of this role will create a “mole in the meetings” atmosphere. Indeed, if the role is not properly defined or the person lacks sufficient expertise, this could be the result. Herein lies a challenge. The ideal person will be a true renaissance woman or man who can perform multiple functions. The person will embody the characteristics of a generalist who understands specialists. They must be a master of interpersonal relationships, both to appease apprehension about an “intruder” and foster a unified team approach to optimize results.

The frequent mantra of a credit union CFO is, “Why must I spend money on a function solely because (place business unit name here) says it is essential to member benefit, retention, growth, etc.?” This role will be to articulate an answer to the CFO from the perspective of one who operates in the trenches and understands the cost/benefit consequences of such implementation. This same one participates in strategic decision making, is astute at needs and trends analysis, and both understands and can articulate the reasons why the CFO should invest.

Concurrently, people in this role must be able to inform and engage other business unit executives to perform with a level of financial perspective. Ideally, the call center manager will better appreciate that the expenditure to implement ABC technology must yield an XYZ return within a justifiable timeframe.

The objective of this role—and the credit union that adopts the model—is a reciprocal enhancement of the depth and breadth of understanding across all business units. Gone will be the days of applying for 150 percent of what one needs, knowing that is what one must do to secure the 75 percent that the CFO in the isolated corner office is likely to grant.

Such change in institutional mindset is not accomplished overnight. Requisite skills and experience of an ideal person(s) are rare, thus the talent search itself will require an investment of time and resources. Once in place, the selected candidate must strive to develop an atmosphere of trust, sometimes addressing pre-existing turf wars that festered long before their arrival. The next step will be to master an understanding of what happens on the front line across all business units and to conceive strategies and tactics that appeal to both staff and members.

The forward-thinking credit union will see this as a ripe opportunity. With today’s favorable economic outlook, now is the time to take a vital step to ensure sustainability and elevate institutional performance to the next level. The inevitable result is the objective of every vibrant credit union: an increase in earnings, member satisfaction and membership growth.

Gene Kirby and Stewart Davis are managing partners of CE Solutions. Together they have more than 60 years of combined experience working across the financial services industry and have strong relationships with executive level contacts at banks, credit unions, trade associations and solutions providers across the industry.