8 minutes

How PSECU made sure its committee structure matched the organization’s size and sophistication

Perhaps now more than ever, credit union boards are faced with challenges threatening their ability to govern effectively. Interestingly, these challenges are not the results of failure, but rather the outcomes of success. While it is true that credit unions face mounting pressures from increasing member expectations, rising costs of capital, voluminous regulatory requirements and an overall fierce competitive environment, many credit unions are thriving—increasing their member bases, growing total assets, and becoming more sophisticated financial institutions. For the credit union boards driving this success, a word of recognition is well deserved, but by the same token, a word of caution in governance is advised.

If you think of board governance as the view from the head of a pyramid, with the pyramid representing a system of decision-making, that view will be very different depending on the height of the pyramid. A board that tries to maintain a 100-foot view from the top of a 500-foot pyramid may experience what directors sometimes refer to as “information overload.” Even worse, a board too focused on the details may miss the big picture. With this in mind, it is important to recognize that a board’s oversight and level of involvement in decision-making must elevate as a credit union grows in size and sophistication.

At Pennsylvania State Employees Credit Union, a $5.2 billion state-chartered credit union, we maintain a corporate governance program dedicated to applying recommended governance practices while ensuring that the board’s advisory and oversight roles remain relevant to PSECU’s size, complexity, and strategic needs. PSECU’s corporate governance program provides assurances to our board that existing practices remain supported by recommended practices and/or offers recommended changes when possible opportunities for enhancement are identified.

One of our recent initiatives involved reviewing PSECU’s board committees to determine whether PSECU’s board committee structure remained relevant and whether these board committees operated according to recommended practice.

We believe that board committees are one of the most important components of an effective governance practice simply because of the extent of material and agenda items submitted to a board for review and approval. Board committees allow for a divide-and-conquer approach that is much more efficient than having every item reviewed in depth by the full board. In this article, I will share how we reviewed PSECU’s board committee structure and practice as a blueprint for performing this type of review in the hopes that it may help your board identify ways to enhance its impact on serving your members’ needs.

We began our process of reviewing PSECU’s board committees by educating ourselves on the typical board committee structure. We wanted to see how PSECU’s board committee structure of an asset/liability committee, audit committee, executive committee, nominating committee, and scholarship committee compared to the board committee setups of other organizations.

Because we were unable to identify a recent survey of credit union board committees, we utilized four recent governance surveys from Spencer Stuart and the National Association of Corporate Directors. We were then able to determine how PSECU’s board committees compared in terms of the types of board committees used and the typical number of standing board committees, frequency and length of board committee meetings, and number of board members per board committee.

The observations from this review were very helpful in identifying three possible board committees for consideration. In addition to the five committees specified above, we researched recommended practices for board compensation committees, nominating and governance committees, and enterprise risk management committees.

To educate ourselves on recommended board committee practices, we consulted with our managers with expertise in areas that support or would possibly support each board committee while also researching recommended practices from organizations specializing in board governance. Consulting with our managers was helpful not only in identifying quality sources about each board committee but also for creating the buy-in needed to recommend changes.

In addition to the sources recommended to us, we identified material on each board committee published by NACD, the Institute of Internal Auditors, Deloitte, CUES, Filene and others. Some of the sources provided sample board committee charters, which were essential to this review. We also found it very helpful to pull sample charters from the investor relations webpages of public banks that had total assets similar to PSECU.

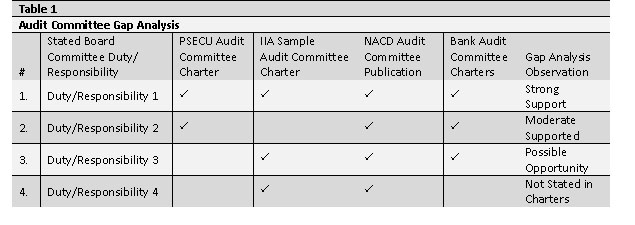

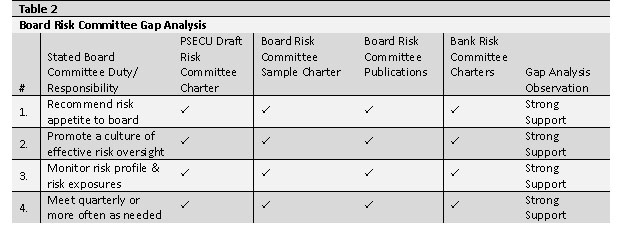

Once we identified a set of sources for each board committee, we performed a gap analysis on the various recommendations. The tables below show the logic behind this review.

The first table shows how this review was performed on an existing PSECU board committee—the audit Committee. As Table 1 shows, this type of analysis can help identify support for existing board committee practices (#1&2), possible opportunities for enhancement (#3), and language recommended for charters but not commonly found within charters (#4). This information can be very useful in recommending changes, or just as important, in recommending that existing board committee practices remain the same.

The second table shows how this review was performed to create a draft board enterprise risk management committee charter.

After performing the gap analyses, we drafted new board committee charters for consideration or tracked-changes copies of the existing board committee charters. This served as a great starting point for discussions with PSECU’s management. From those discussions, we were able to revise the recommended changes and find what worked best for PSECU’s specific needs. Each of the recommended board committee charters were also reviewed by the relevant PSECU senior managers to ensure that they supported the changes. Finally, the changes were presented to the full PSECU board for discussion and next steps.

For PSECU, the primary outcome of this review was a decision to move forward with exploring the possibility of a board ERM committee. While we are still determining how a board ERM will influence the existing board committee structure and responsibilities, one option we are considering is transferring the board asset liability committee risk responsibilities (i.e., interest rate risk, liquidity risk, and concentration risk) to the board ERM committee.

We are also considering transferring primary risk oversight of other risk categories (e.g., cyber security risk, legal/regulatory risk) from the audit committee to the board ERM committee. Another key recommendation being explored is expanding the nominating committee’s responsibilities to include such typical governance responsibilities as reviewing and acting upon the findings of the board’s various governance surveys (e.g., composition surveys, board surveys, third-party governance evaluations).

While the best process for performing this type of review will depend on your credit union’s specific needs and capacity, this process worked well for us and we hope sharing our experience will help you consider options available to perform this type of governance review. We also wish to champion the work of the credit union board, and how optimizing this work can help a board maximize its impact on benefiting members’ lives and financial well-being.

Moreover, and to help with any similar initiative your credit union might undertake, listed in the sidebox on this article are the most relevant sources we identified as part of our review. I am also happy to answer any questions you may have on this research and always appreciate the opportunity to learn about another credit union’s governance practice.

Sam Isaacman is administration analyst II at PSECU, Harrisburg, Pa.

Apply It to Your Boardroom

- Are your board committees relevant to your credit union’s size, complexity, and governance needs?

- Are your board committees operating in accordance with recommended board committee practices?

- Would fewer or more board committees help your board become more efficient?

- Are you assigning the right board members to the right board committees?

- Are your board committees duplicating oversight

Most Relevant Sources PSECU Used to Review Board Committees

Governance Surveys

2016-2017 NACD Public Company Governance Survey

2015-2016 NACD Nonprofit Governance Survey

2015-2016 NACD Private Company Governance Survey: Family Business Boards

2016 Spencer Stuart Board Index

General Board Governance Literature

Leblanc (2016) The Handbook of Board Governance

Larker (2016) Corporate Governance Matters

Hoel (2011) Boards and Leadership: How Boards Can Add More Value

Hoel (2011) Boards and CEOs: Who’s Really in Charge?

Hoel (2011) Power and Governance: Who Really Owns Credit Unions?

CUNA (2016) Credit Union Board of Directors Handbook

Compensation Committees

Sample Charter: NACD (2015) Report of the NACD Blue Ribbon Commission on the Compensation Committee

Bank Charters: Bank compensation committee charters via investor relations webpages

Enterprise Risk Management Committees

Sample Charter: Deloitte (2012) Risk Committee Resource Guide for Boards

Bank Charters: Bank board risk committee charters via investor relations webpages

Tonello (2012) Should Your Board Have a Separate Risk Committee?

NACD (2009) Report of the NACD Blue Ribbon Commission on Risk Governance: Balancing Risk and Reward

Asset Liability Committees

ProfitStars (2015) A Plain English Guide to Asset/Liability Management for Community Credit Unions

Nominating & Governance Committees

Sample Charter: NACD (2007) Report of the NACD Blue Ribbon Commission on The Governance Committee: Driving Board Performance

Bank Charters: Bank nominating/governance committee charters via investor relations webpages

NACD (2016) Report of the NACD Blue Ribbon Commission on Building the Strategic-Asset Board

Audit Committees

Sample Charter: The Institute of Internal Auditors (2013) Model Audit Committee Charter

Bank Charters: Bank audit committee charters via investor relations webpages

NACD (2010) Report of the Blue Ribbon Commission on The Audit Committee

Deloitte (2009) Best Practices for the Audit Committee

National Credit Union Administration (1999) Supervisory Committee Guide for Federal Credit Unions