4 minutes

The State of Credit Union Governance, 2018 report finds credit unions are more certain of their current mix of directors than they are about the future composition of their boards. Here’s what this means for board renewal.

Data from our new report, The State of CU Governance, 2018, find that the majority of credit unions feel pretty good about who’s currently on their boards—but are much less sure about the future.

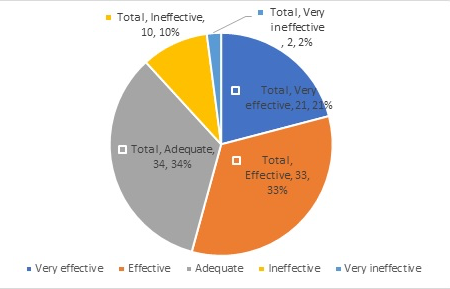

Almost three-quarters of survey respondents (74 percent) of respondents report that their boards are “effective” or “very effective” at having the right mix of skills/experience to accomplish [their] governance roles and responsibilities. But remarkably, almost half of all of the survey respondents (46 percent) describe their effectiveness in “attracting the right people to serve on the board” in the future as only “adequate,” or “ineffective” or “very ineffective.”

Figure 1: Attracting the Right People to Serve on the Board - Overall

Our experience is that your collective worries about attracting the right folks to serve on your credit union’s board are well-founded—and things may get worse before they get better!

The number of board members available to serve in the coming years is likely to shrink. Using generational definitions from Pew, the Boomer generation (born 1946–1964) consists of 76 million people and is shrinking. Generation X (born 1965 – 1980) is estimated to be only around 55 million people, causing a significant lack of potential board members for a good number of years until the much larger millennial generation (born after 1980) begins to peak. This means that you and your board colleagues will be competing more and more for fewer and fewer potential board members.

In his book, Generations: The Challenge of a Lifetime for Your Nonprofit, Peter C. Brinckerhoff notes that both members of Generation X and millennials typically volunteer for different reasons and in different ways than members of the Boomer generation. Brinckerhoff goes on to say that members of the Boomer generation historically committed to volunteerism in support of institutions, whereas younger generations volunteer in support of people and issues rather than organizations. They often prefer discrete projects rather than large commitments, and they can experience all that volunteerism has to offer without having to be commit to regular “face-time,” all of which goes against traditional board service.

So, how do you attract, and then keep, the ever-elusive millennial? Here are a few do’s and don’ts to consider as you work to refresh your board’s membership:

DO:

- Talk about your credit union’s mission. Millennials are often cause- or mission-driven, but ensure that you’re talking to them in language they understand, using today’s technology.

- Mix your credit union’s business with passion. Ensure that your board meetings are not all business. While addressing the business of the day is important, see that you are also addressing the broader, strategic impact that your credit union is having (see point No. 1, above).

- Bring them on in multiples. That is, don’t just add one millennial at a time to your board or its committees; add a number of them so that they don’t feel like a token (see point No. 1, below).

DON’T:

- Treat them as tokens. It seems like everyone is talking about adding a millennial to their boards. Ensure you have a meaningful role for them to fill on your board and its committees (see also point #3 above).

- Under-estimate their abilities & skills. They have a lot to contribute; ensure that you are listening and learning from them.

- Think of them as “kids.” While for many board members, they may be the same age as your kids, they are not your kids. Treat them with the professional respect that they are due.

Michael Daigneault, CCD, is CEO of Quantum Governance L3C, Vienna, Va., CUES’ strategic provider for governance services. Daigneault has more than 30 years of experience in the field of governance, management, strategy, planning and facilitation, and served as an Executive in Residence at CUES Governance Leadership Institute.

Jennie Boden serves as the firm’s managing director of strategic relationships and a senior consultant. She has 25 years of experience in the national nonprofit sector and served as the chief staff officer for two nonprofits before coming to Quantum Governance. Quantum Governance provides credit unions and other organizations strategic, cost-effective governance, ethics and management consulting, facilitation and evaluation.